Table of Contents

The purpose of this strategy is to help you understand your choices regarding your current or future retirement, and to assist you with improving your outcomes throughout your retirement. This is not intended to be financial product advice.

The Challenger Retirement Fund (the Fund) is a superannuation fund which services a specific need for you. The investment objective of the Fund is to provide you with a guaranteed income stream or a guaranteed rate of return so that you can plan for your retirement with certainty.

As all the products in the Fund are closed to new members, you might need to use investments outside the Fund to generate additional income in retirement. The Fund products are not intended to be the sole solution for your retirement strategy. Rather, a combination of income streams may be ideal for assisting you to achieve and balance your retirement objectives.

Subscribe to Horizons newsletter

Horizons is our newsletter designed for retirees or those planning for their retirement. Subscribe now to receive our latest information to help you live and age well in retirement in Australia.

Key retirement objectives

The Fund's Retirement Income Strategy aims to assist you to balance and achieve the three key objectives in retirement:

- maximise your retirement income;

- manage risk; and

- allow flexible access to your money.

Maximising retirement income

Income which is sustainable and stable can help you maximise your income throughout your retirement. Sustainable retirement income is income that is reliable and long-lasting. Stable retirement income is income which is constant and predictable each year. So ultimately, the aim is to have income which you can rely on and will be there for the rest of your life.

Managing risks

Consideration should be given in retirement to managing key risks to meeting your retirement income goals, including:

Flexible access to your money

It is important to consider access to money you can draw on at any time for planned or unexpected expenses. This can help you avoid the need to withdraw from your investments at inopportune times.

Retirement Income Strategy

A guaranteed lifetime income stream can work alongside an account-based pension

It is unlikely that a single retirement income stream alone will enable you to maximise your retirement income, manage risks and provide flexible access to your money, but a combination of income streams can help you to achieve this.

Two types of income streams which are integral to the Fund’s Retirement Income Strategy are an account-based pension and an inflation-linked lifetime income stream (guaranteed lifetime income stream). The following table compares how each type of income stream helps to address the key retirement objectives.

Account-based pension | Guaranteed lifetime income stream | |

|---|---|---|

| Regular payments | Yes | Yes |

| Longevity protection | No | Yes |

| Inflation protection | No – your payments may increase in line with inflation over time, but generally your capital isn’t protected as you are simply just withdrawing more from your balance. | Yes |

| Protection against market risk | Usually, no | Yes |

| Easy access to your money/ability to make partial withdrawals | Usually, yes | While lifetime income streams are designed to be held for life, some provide a long period where you can access a lump sum if your circumstances change. Partial withdrawals are not generally available. |

While the Fund does not have an account-based pension or lifetime income stream open for new investment, you can consider these investments outside of the Fund. You could also consider other types of income streams however they might not help you manage all your retirement objectives.

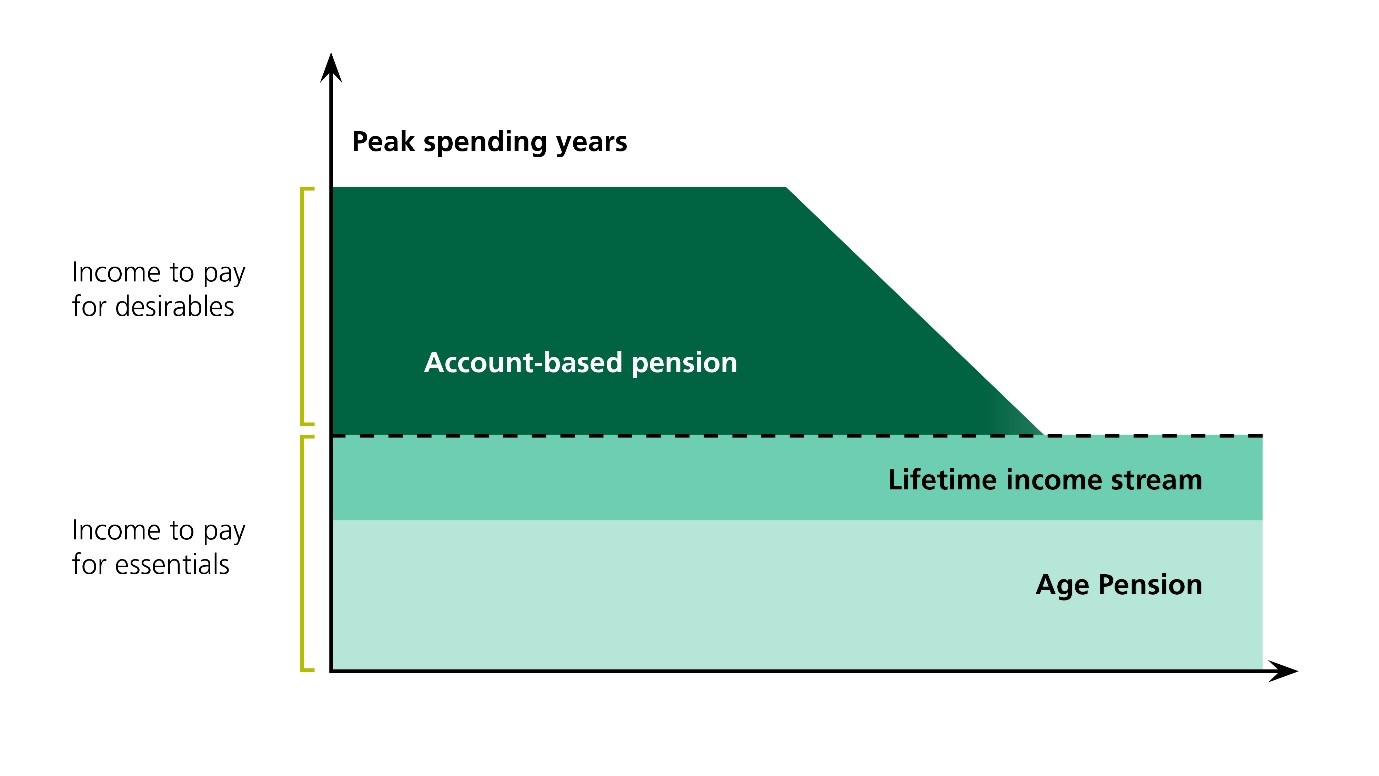

- Income layering

- How much guaranteed lifetime income should I have?

- Project how long your retirement income will last

An income layering approach enables you to lock in a minimum baseline income for life while still providing access to your money. This baseline income will be available to help you meet your essential spending needs for life. Any income on top of your baseline income is considered as desired income.

An income layering strategy has three core income components:

- Age Pension (if eligible);

- lifetime income stream; and

- account-based pension

While the Age Pension is a sustainable, stable and risk-protected income stream, for many retirees it will be a safety-net only – it might not be enough to maintain your desired lifestyle in retirement and might not even cover your essential expenses. To meet your essential expenses throughout retirement, the Age Pension can work together with a secure, lifetime income stream, such as a lifetime annuity, to provide regular, top-up income payments for life. Additionally, a lifetime income stream could help boost your Age Pension today1.

Once your essential expenses have been met through a combination of the Age Pension and a lifetime income stream, you can meet your additional desired expenditure goals with income from an account-based pension. An account-based pension generally provides access to a range of investment options, allows lump-sum withdrawals and gives you the option of changing your income payments (so long as you take the required minimum each year).

An income layering strategy can therefore help you meet the three key retirement objectives:

- maximising your retirement income;

- managing risks; and

- having flexible access to your money.

The Age Pension and lifetime income stream help to protect against inflation, longevity and market risk, while the account-based pension provides flexible access to money. All three income streams combined can help to provide you with higher income over your retirement.

While this depends on your individual circumstances, a good starting point is to consider how much income you need in retirement.

The Association of Superannuation Funds of Australia (ASFA) publishes ‘Retirement Standard’ figures four times a year, which can help you get an idea of the income you will need to match your lifestyle income needs. The table below compares these Retirement Standards to the full Age Pension amount.

Association of Superannuation Funds of Australia (ASFA) Retirement Standard figures

Comfortable lifestyle budget p.a. | Modest lifestyle budget p.a. | Age Pension p.a. | |

|---|---|---|---|

| Couples aged around 65 | $73,077 | $47,470 | $45,037 |

| Single person aged around 65 | $51,805 | $32,897 | $29,874 |

Full Age Pension rate as at 20 March 2025, ASFA budgets as at December 2024 quarter.

This shows that the ASFA modest retirement lifestyle is slightly above the full Age Pension amount.

If you can meet your essential expenditure needs with the full Age Pension alone then a lifetime income stream might not be necessary for you. Similarly, if you have enough money to provide your desired income for life without ever needing the Age Pension, a lifetime income stream might not be necessary for you.

However, if you are like many retirees in Australia who can’t meet their essential expenditure needs with the full Age Pension alone, and your income from other sources is not enough to meet these expenses for life, then a lifetime income stream might be necessary to maintain your lifestyle over the course of your retirement.

You should consider how much income on top of the full Age Pension amount you need to meet your essential expenses in life. Investing a proportion of your retirement savings into a lifetime income stream that will provide this amount of additional income can help you fill the gap between the full Age Pension and your essential expenditure needs.

You should consider your own personal circumstances and preferences before making any decision. Professional financial advice can help you determine how much income you need on top of the full Age Pension amount and what type of lifetime income stream is most appropriate for you.

The following useful spending planners can help you to determine whether you can live on the full Age Pension, and if not, help you determine how much lifetime income you might need on top of the full Age Pension:

It is not always easy to understand how long your retirement savings will last or how much Age Pension you will be eligible for. The Challenger Retire with Confidence tool can help you to:

- see how long your superannuation savings will last;

- determine how much Age Pension you may be eligible for; and

- understand how a lifetime income stream could help you meet key retirement objectives.

How your product fits into the Strategy

Resources

We have a range of educational resources to assist you when you are in or approaching retirement.A guide to a confident retirement

Aged care

Whether considering options for yourself or deciding how best to help someone close to you, aged care is a complex area that requires careful thought.

Planning my retirement income

Making sure your money goes the distance really matters in retirement so it’s important to understand the sources of income available to you and what role they may play in supporting you in retirement.

Retire with Confidence tool

Estimate how long your super savings might last in retirement, possible Age Pension Payments and the impact of including a guaranteed income stream as part of your portfolio.

How much do you need to retire?

These spending planners for couples and singles can help you determine how much you ‘need’ (essential spending) and how much you ‘want’ (discretionary spending).

Case study

Cafe owners Fiona and Frank have recently retired. To help fund their retirement, they decided to sell their cafe and contribute the net proceeds from the sale to top-up their superannuation.

Fiona and Frank are looking for a comfortable retirement and have estimated they would need an income of about $70,806 p.a. to help fund it. They’re sure they can’t get by on the Age Pension alone (they are currently receiving $34,525 p.a.) and think they’ll need at least $50,000 p.a. to meet their basic living expenses.

See here for how Frank and Fiona achieve their 'comfortable' lifestyle in retirement by using a combination of income streams.

Financial advice

Getting quality financial advice can help you retire with confidence.

Find a financial adviser

If you’d like some assistance finding a financial adviser, simply fill out our form online and let us know some of the things you’d like to speak with an adviser about.

We’ll contact you with a shortlist of financial advisers for you to choose from2. A financial adviser can help you tailor a retirement income solution for your situation.

Financial adviser register

The Government also has information available on their Money Smart website, including:

- a Financial Adviser Register – You can check financial adviser locations, qualifications, and previous employment;

- tips for choosing an adviser;

- an explanation of financial advice costs.