Table of Contents

Everybody has a different starting point in retirement. Whether you're fortunate enough to retire on your own terms, or are retiring later than you expected, a key to retiring with confidence is knowledge.

How much income do you need?

The time you’ll spend in retirement and the lifestyle you’re planning both make a difference to the savings and income you’ll need. Being realistic and getting clear about plans for your future can help you figure out the cost of your ideal retirement.

- Estimating income requirements

- Compare lifestyle standards to help assess your income and spending needs

- Spending planners

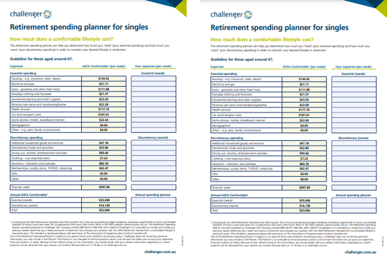

Retirement Standard figures from The Association of Super Funds of Australia (ASFA) make a good starting point for estimating the income you might want or need. By comparing these estimates with your own spending plans, you’ll get a rough idea of how your overall spending in retirement could add up.

Comfortable lifestyle (p.a.) | Modest lifestyle (p.a.) | Age pension (p.a.) | |

|---|---|---|---|

| Couples aged around 65 | $73,031 | $47,475 | $44,855 |

| Single person aged around 65 | $51,814 | $32,930 | $29,754 |

Full Age Pension rate as at 20 September 2024, ASFA budgets as at September 2024 quarter.

You can read more on ASFA’s Retirement Standards in this article or visit ASFA’s website.

| Our online interactive retirement spending planners for singles and couples can help you figure out how much income you may need in retirement. You should consider what your essential costs are and also what your discretionary expenses might look like so you can understand your total desired retirement income requirements. |  |

What is the retirement age in Australia?

Start planning for retirement

Everybody has a different starting point in retirement. Whether you’re fortunate enough to retire on your own terms, or if you have to retire earlier or later than expected, a key to retiring with confidence is knowledge.

How long will you spend in retirement?

In order to understand how long your retirement savings may need to last, it’s helpful to know the life expectancy of Australians.

Australians are living longer due to improvements in medical care and living standards. According to Government actuaries, a 60 year old male has a 50% chance of living for another 28 years and that number increases to 30 years for a 60 year old female.

You can read more on life expectancy in the article below.

How many more years are you likely to need to plan for?

Challenger estimates that an Australian male aged 65 could expect to live to 88, while female aged 65 could expect to live to 90.

| Current age | Male (50% chance)i | Female (50% chance)i |

| 60 | 28 years | 30 years |

| 65 | 23 years | 25 years |

| 70 | 18 years | 20 years |

| 75 | 14 years | 16 years |

i Estimates calculated using Australian Life Tables 2015-2017 with 25-year mortality improvements as provided by the Australian Government Actuary. There is a 50% chance of living for this number of years at these ages.

Calculate how long your savings will last

Use this tool to estimate how long your retirement income might last, the amount of Age Pension you may be eligible for and the impact of adding an inflation-linked lifetime income stream to your retirement portfolio.

Additional reading

Age Pension eligibility

Longevity risk

Helpful links

Subscribe to Horizons

Horizons is our newsletter designed for retirees or those planning their retirement. Subscribe now to receive our latest information to help you live well in retirement in Australia.