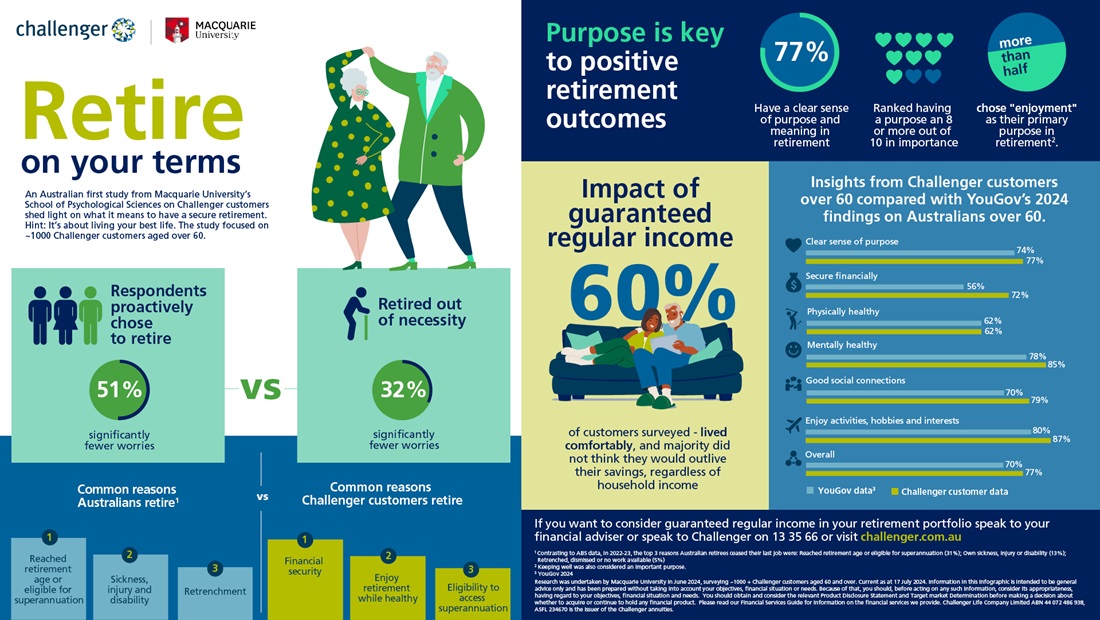

An Australian first study from Macquarie University’s School of Psychological Sciences on Challenger customers shed light on what it means to have a secure retirement

Mandy Mannix

Hear from Mandy Mannix: Chief Executive, Customer

Guaranteed regular income helps instil a sense of security

"There are no shortage of opinions on annuities, but now for the first time we are hearing from real customers, and it's clear that annuities, or some element of guaranteed income is a winner," Challenger Chief Executive, Customer, Ms Mandy Mannix said.

"When you know that a portion of your savings is guaranteed to last a lifetime, it brings an unparalleled sense of security. This confidence in receiving a regular pay check for life allows you to focus on what truly makes you happy."

Having proactive control in how we retire could lead to better wellbeing in retirement

“Proactively choosing to how and when to retire has been revealed may be the secret ingredient to wellbeing in our golden years,” Professor Joanne Earl from Macquarie University School of Psychological Sciences said. “The findings demonstrate that choice and control result in a healthier transition and greater retirement happiness and satisfaction."

Meet Graham

Professional singer Graham appreciates the monthly income that his lifetime annuity brings him. Combined with the Age Pension he says he’s set up properly and he doesn’t have to worry.

Discover more

What is an annuity?

Retire with Confidence tool

A guide to income in retirement

Subscribe to Horizons

Horizons is our newsletter designed for retirees or those planning their retirement. Subscribe now to receive our latest information to help you live well in retirement in Australia.