More resources for advisers

Our Challenger Adviser Knowledge Hub has a large range of resources for advisers including product and technical information, articles and guides.

The fall in inflation from multi-decade highs is good news for the Australian economy. Many retirees are struggling to manage their cost of living because of the cumulative impact inflation has had on their financial position.

Looking forward, retirees need a portfolio that is protected from inflation risks so that they don’t experience another cost-of-living crisis when inflation has another upturn.

Maintaining the long-term real value of investments

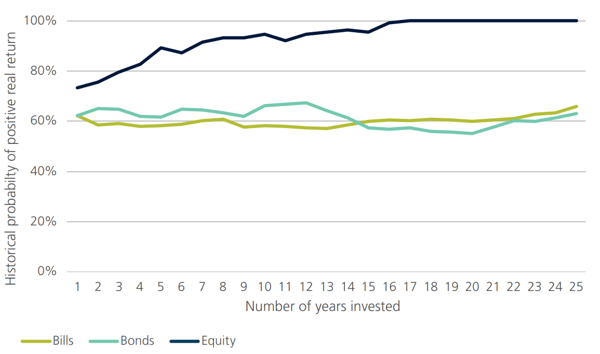

The key to a successful investment strategy is the ability to generate returns over the long term. Managing inflation is an important piece of the strategy. Long term investments need to be able to generate a real rate of return that provides growth in the investment value. The investments do not need to capture short-term inflation changes, but they need to offset the impact of inflation over time. Assets that are expected to do this are generally referred to as ‘growth’ assets. To demonstrate this, we can look at the historical performance of assets over the long run1. Looking at Australian investment returns between 1900 - 2023, equities provided a return higher than inflation in 81 years which was 73% of the time. The one-year success rate for bonds and bills (cash) were lower, constrained by historical limits on bond yields. Both bonds and bills provided a one-year real return only 62% of the time in the same period.

The long run probabilities are shown in Figure 1. As the investment horizon extends out, up to 25 years, the probability of equities providing a real return increases. The higher returns on the investment eventually overcome any initial shortfall. Bond and bill investments show little improvement with a longer investment horizon2. At horizons of 20 years, the probability of delivering a positive real return from nominal bonds was only 60%. Historically, all investment horizons of 16 years (and longer) have provided a positive real return for Australian equities. While history does not provide a guarantee, the increase shown in Figure 1 should provide confidence that a long-term investment in equities will provide real capital growth. This analysis can be extended to diversified products such as a 70/30 growth fund (70% equities and 30% bonds) and a 50/50 balanced fund (50% equities and 50% bonds). These both show trend improvements over time, benefiting from the exposure to growth assets, but over longer periods. The 70/30 fund needed 20 years and the 50/50 fund 25 years historically to ensure the positive real return.

The portfolio comparison in retirement is important in the generation of income over longer periods. If income is taken as a set percentage of the balance than changes in income will directly link to market movements. Also, there are market-linked annuities available in Australia where the capital is consumed but the income, which is paid for life, will be directly linked to the performance of the specified market or underlying investments. This paper provides a historical basis to consider the inflation protection provided by these income streams. Historical investment performance is not a reliable indicator of future performance, but it is worth considering the timeframe for recovery from historical shocks.

Figure 1: Historical probability of positive real returns, 1900-2023

Source: Calculations, based on data from Morningstar, S&P, Bloomberg and ABS

Inflation risk in retirement

Inflation is often called out as a risk in retirement that needs to be managed differently. Longevity and sequencing risks are also noted as being different, and these are not present in the accumulation phase. One of the challenges with managing inflation risk in retirement, is that inflation risk has a different impact on a portfolio in the retirement phase. Management of inflation risk in retirement needs a different approach. It is not just that capital needs to regain its real value, but every income payment needs to keep its value to maintain the target lifestyle of the retiree.

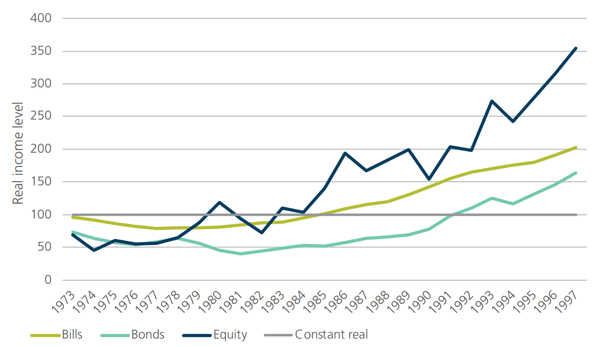

We can examine this difference by considering the outcome for someone who started to draw an income at the start of 1973. This was one of the worst years in the historical comparison where the inflation spike meant that any investment-linked income would be falling in real terms in the first year. If a retiree’s income was linked to an investment, the real value would have declined for any of the three assets: Bills by 3.5%; Bonds by 26% and Equities by 30.7%. What happens over time is the recovery in the level of income. Income linked to equity performance briefly exceeds the original value in 1980 but dips again before maintaining real gains from 1983. Bills provide higher real income from 1985 while bonds will take until 1992. The 19-year impact on bonds highlights the exposure that nominal bonds have to inflation risks. The pattern for income linked to the different markets from 1973 can be seen in Figure 2.

Figure 2: Investment-linked income example

Source: Calculations, based on data from Morningstar, S&P, Bloomberg and ABS

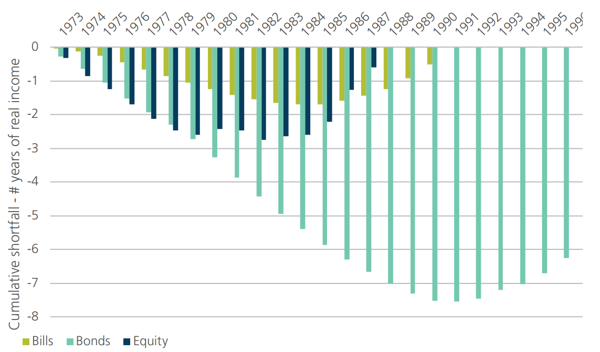

There is more at stake for retirees. The impact is not just the length of time to recover the real capital value, but the income that is lost over that period. For the nine years that the real equity-linked income is under the starting point, a retiree needs to reduce their lifestyle or run their capital down early. The shortfall is shown in Figure 3. It highlights the cumulative shortfall in income, relative to the initial lifestyle of the retiree. The starting point is where inflation risk creates an impact which might be after the start of retirement.

The shortfall highlights the extent of the impact from an inflation shock. The worst performance is from bonds, where more than 7 years of income (lifestyle) were lost over a 17-year period before a modest recovery. For equity-linked income, nearly three years of lifestyle were lost over nine years. While there was a strong recovery after, this is an average of a third of total spending that needs to be cut for an extended period. Cash investments took longer to fully recover, but the extent of the pain was not as large. The worst point is ten years after the shock, where the retiree has missed 1.7 years of real spending.

Figure 3: Cumulative shortfall in real incomes

Source: Challenger calculations, based on data from Morningstar, S&P, Bloomberg and ABS

The extended pain highlights why inflation risk is an additional risk to consider in retirement. It is not just the capital recovery, but it is the lost lifestyle that happens when an income stream does not keep pace with inflation. Retirees that choose a market-linked income stream need to have the capacity to sustain a potential extended period of reduced lifestyle before they can enjoy an increased lifestyle later in retirement.

Payment profiles and income indexation

The analysis so far has highlighted how inflation shocks can impact a lifestyle based on an initial spending level. In practice, not all spending profiles are the same. The different approaches to generating income provide differing levels of starting income. There are some differences in product features that impact the payment rates, so for comparison we will look at rates for Challenger Lifetime Annuity (Liquid Lifetime) options as at 8 April 2024 where the lifetime income streams all include capital access and a death benefit in line with the maximum allowable under the Capital Access Schedule3. The differing options for indexation of an income stream include:

- CPI-linked lifetime income

- Market-linked lifetime income4

- Accelerated payments with market-linked lifetime income

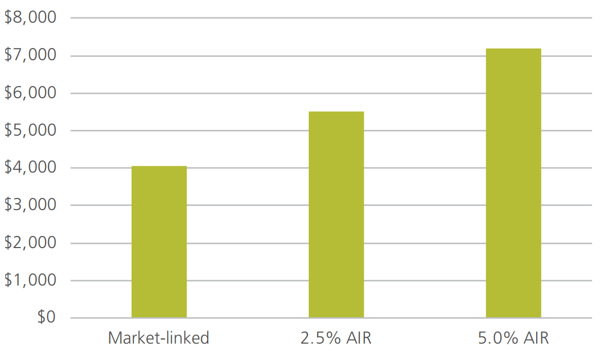

A CPI-linked lifetime income stream sustains the lifestyle of the retiree by adjusting their payments with changes in the cost of living. A market-linked income stream uses an indirect approach, that requires market movements to exceed CPI inflation over time to maintain the lifestyle of the retiree. Accelerated payments are designed to smooth the income profile of market-linked income streams. Recognising that payments are expected to grow over time, some of the income can be front-loaded by indexing the payments by a fixed percentage lower than the market return. This provides a higher starting payment that will grow more slowly. This fixed percentage is sometimes called the assumed investment rate (AIR). The analysis includes payments for an AIR of 2.5% p.a. and 5% p.a. The difference in the initial payment rates as shown in Figure 4 can be substantial.

Figure 4: Initial payment rates

Source: Challenger, as at 8 April 2024

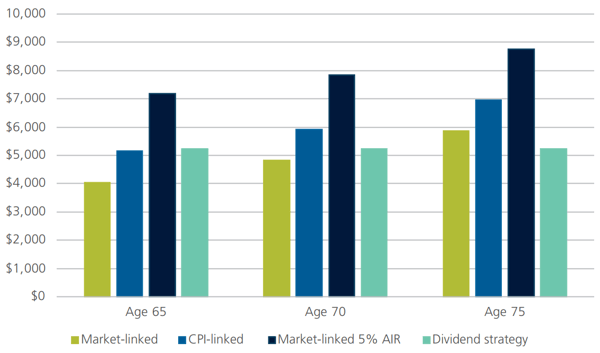

Current rates provide a range of starting payments, per $100,000 of around $4,000 to $7,000 a year, for a 65-year old male. A market-linked lifetime annuity with a 5% AIR has payments starting at a rate 78% higher than one with no AIR. Over time the payments will increase by 5% less each year so over time the payments will cross over. This wedge is independent of market movements.

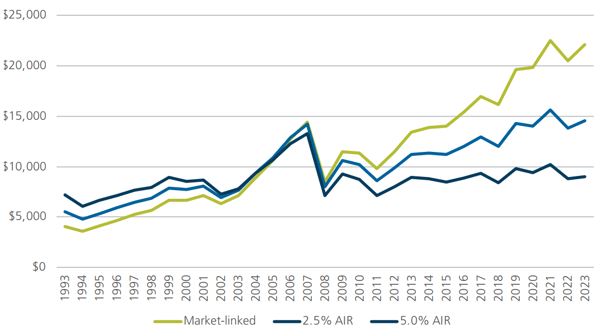

The paths for the 30 years from Dec 1993 to Dec 2023 can be seen in Figure 5. This shows the five-fold increase for payments that were linked to the accumulation performance of the S&P/ASX200 over that time. The 5% AIR hurdle provided the highest initial payment, but lower indexation meant that this would not have been the highest after 2004, only 11 years into retirement. The smaller increase in the payments with a 5% AIR would not have kept up with inflation from the initial payment level. It provided a flatter spending profile that declines in real terms.

Figure 5: Market-linked payments over time

Source: Challenger, S&PASX200

Dividend strategy

Another approach with an equity investment is to use only the dividend payments for retirement income. Dividend yields tend to be counter-cyclical so dividends are not as volatile as share prices. The question is how well they keep up with inflation over time. Again, we can use the available historical data5 to see what might have happened. One difference is that none of the dividends are reinvested. When dividends are higher, a market-linked strategy effectively reinvests the excess. A dividend strategy spends this excess which has an impact over longer horizons.

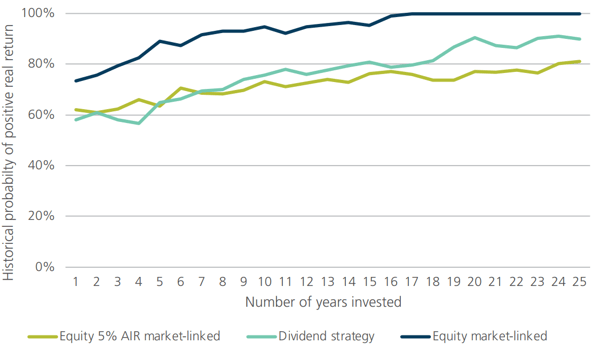

Another difference with a dividend strategy is the starting income levels. The starting income reflects the dividend yield available at the time, with no consumption of capital over time. The first challenge is to see if the dividends protect from inflation for the given starting level. Figure 6 highlights how the dividend strategy does not provide the same level of protection of an equity market-linked strategy. It begins with a 60% success rate, similar to the equities market-linked strategy with a 5% AIR. Over time, the success rate improves, but it does not match an equity market-linked strategy. Historically, dividend growth over 25 years was below inflation in 10% of the scenarios. The earliest in this sample was 1929-1954 and the latest was 1969-1994.

Figure 6: Inflation protection of a dividend strategy

Source: Challenger calculations, based on data from Morningstar, S&P, BHM, Bloomberg and ABS

The dividend strategy maintains the capital invested in the underlying equities so the income payments will be lower than what can be achieved if the capital is consumed over retirement. On average, the dividend yield has been 4.65% p.a. and is currently 5.2% including franking credits. Investors might expect inflation protection similar to an equity-linked 5% AIR investment. In practice, the initial income is lower with a dividend strategy, but the lower income is better protected than the 5% AIR strategy. However, it can take a long time to catch up the initial income gap.

Another impact of maintaining the capital is that the dividend strategy does not increase payments at older ages. The comparison to market-linked lifetime income streams is shown in Figure 7 which shows that only the market-linked strategy with a 5% AIR has a higher initial payment at age 65, but by age 75, the dividend strategy provides lower payments than any of the other strategies. This demonstrates that a dividend strategy supports a lower lifestyle than a strategy that will consume capital over time. Retirees are unable to maximise the money available to spend through retirement if they do not draw down on their capital.

Figure 7: Initial payment rates per $100,000 investment at different ages

Source: Challenger as at 8 April 2024 with calculations based on S&P data as at Dec 2023

Age Pension

Another consideration for retirees thinking about inflation protection is their entitlement to the Age Pension. Around two in three current retirees receive at least a partial Age Pension, and while this is likely to decline, a significant proportion of retirees will continue to receive some Age Pension in the future. The Age Pension provides an income stream that automatically increases with inflation. Over time, it will also increase with real wages growth, but the real wage declines in recent years mean that it is probably still several more years until the Age Pension will increase more than inflation. The mechanics of the Age Pension indexation can result in retirees receiving a partial Age Pension being over compensated. The full Age Pension payment is indexed and any means-tested amounts are calculated relative to the new full payment. While earned income is likely to increase with inflation, the assets held by an asset-tested pensioner might increase by less than inflation, or even fall. In this case, the proportionate increase in Age Pension payments might be higher than inflation reducing the need to fully protect a retirement portfolio from inflation. This protection is provided only up to the value of the Age Pension. If a retiree has any lifestyle requirements above the safety-net provided by the Age Pension they need to be fully protected against inflation.

Conclusion

Protecting an investment portfolio from inflation can be an important concern for any investor. In retirement, the challenge increases as a retiree needs to protect their income stream to be able to sustain their lifestyle. While some investments can protect against inflation over the long run, market-linked investments don’t necessarily protect an income stream from inflation over the short to medium term. Retirees who want to be able to maintain their lifestyle need the inflation protection that can be provided by a CPI-linked income stream. The Age Pension will deliver some of this for retirees, but those with a lifestyle goal above the Age Pension’s safety net will need an additional source of inflation-protected income.

1 The historical data in this paper comes from the Dimson, Marsh and Staunton dataset as provided by Morningstar. Recent data on indices relates to the S&P/ASX 200 Accumulation index, Bloomberg AusBond Composite 0+Yr Index and Bloomberg AusBond Bank Bill Index. Recent inflation data is the CPI sourced from the Australian Bureau of Statistics.

2 The majority of these periods were between 1933 and 1973 when bond yields were set by regulation.

3 For an explanation of how the Capital Access Schedule operates see: 4.9.3.35 Means test assessment of asset-tested income streams (lifetime) | Social Security Guide (dss.gov.au).

4 Different market-linked options are available, but the initial payment is the same for each option.

Related content

Inflation expectations: alert but not (yet) alarmed