More resources for advisers

Our Challenger Adviser Knowledge Hub has a large range of resources for advisers including product and technical information, articles and guides.

Over the past month, a key measure of inflation expectations has jumped from 2.5% (the centre of the RBA’s target) to 2.7%. Inflation data released in October were higher than expected and so does this suggest financial markets think the RBA has lost control of inflation?

That would be a concern for the RBA given the RBA’s statement of a low tolerance for a slower return of inflation to target. High and rising inflation expectations would risk being baked into wage setting and contracts making high inflation more persistent. The RBA would then need to raise interest rates further to engineer a sharper slowdown in economic activity. But while inflation expectations are too high, a broader range of inflation expectations are stable or even decreasing so we should be very alert but not yet deeply alarmed about inflation expectations becoming ‘de-anchored’.

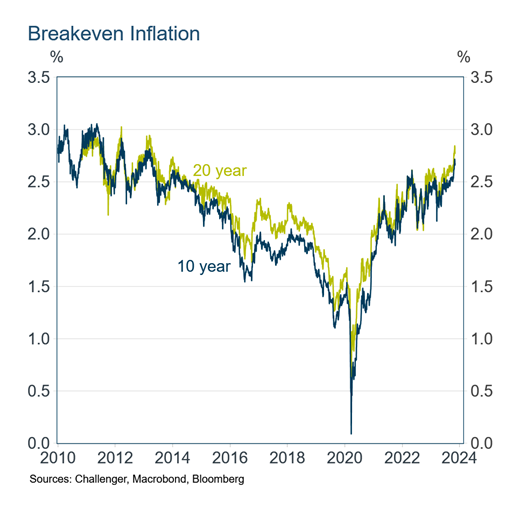

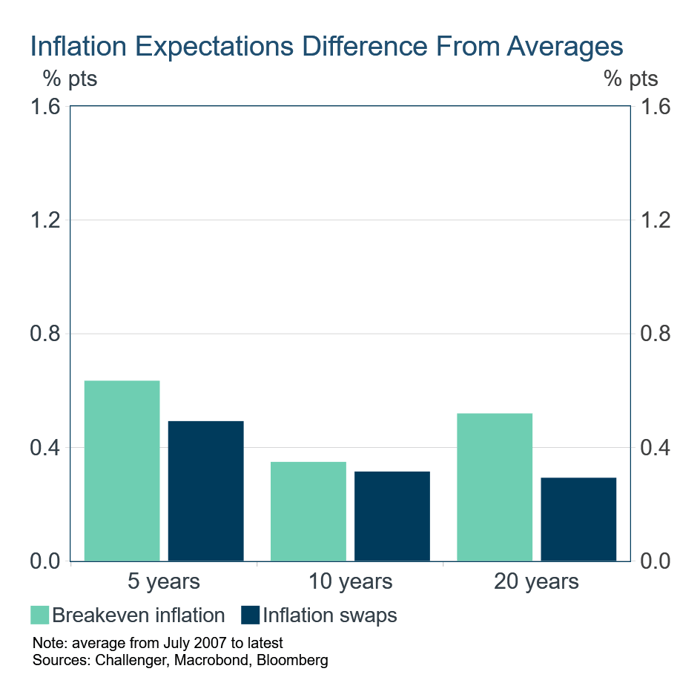

The cause for alarm has been the jump from 2.5% to 2.7% in ‘breakeven inflation’, the expected inflation rate over the next 10- or 20-years implied by the difference between yields on nominal and real (indexed to inflation) government bonds. This jump in breakeven inflation rates over the past month has occurred only in Australia suggesting markets are concerned about the RBA’s commitment to returning inflation to target. However, breakeven rates can be a noisy measure of inflation expectations (because the illiquidity premiums in real bonds relative to nominal bonds can vary over time). Several things have contributed to Australia getting richer over recent decades, but it’s likely to be harder going in coming years.

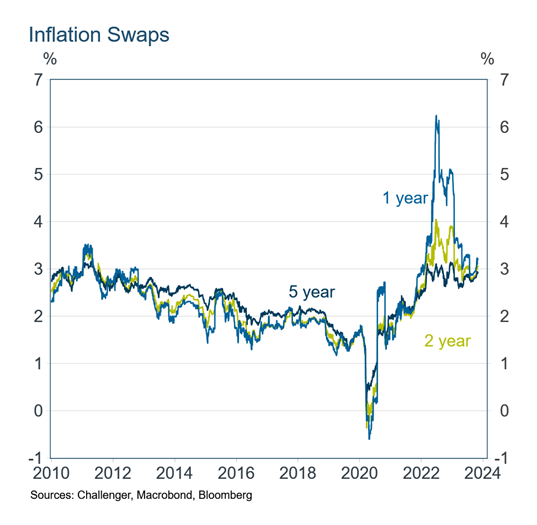

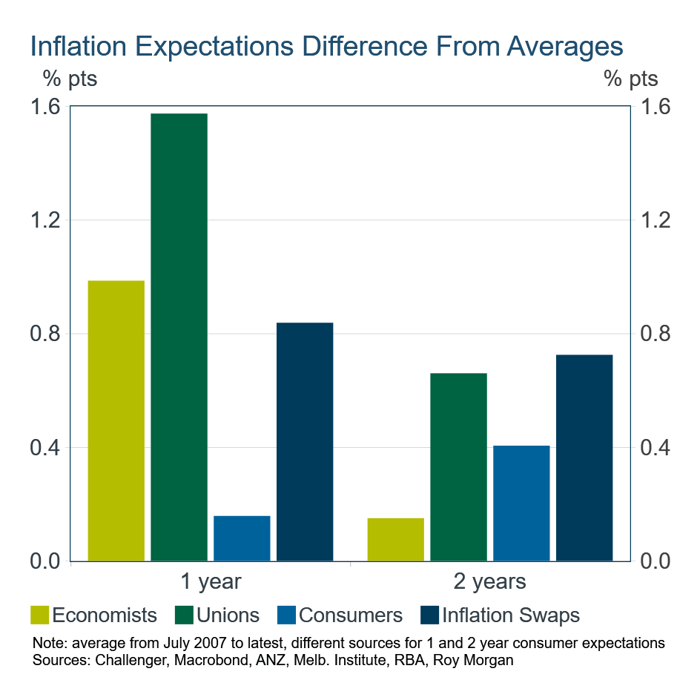

Inflation swaps are another measure of inflation expectations in financial markets (a swap contract where one party makes payments based on the inflation rate in the swap contract and receives realised inflation rate over the length of the contract). The 1-year inflation swap jumped a little in late October, consistent with the release of stronger than expected inflation data, but swaps from 2- to 20-year horizons suggest inflation expectations have not increased.

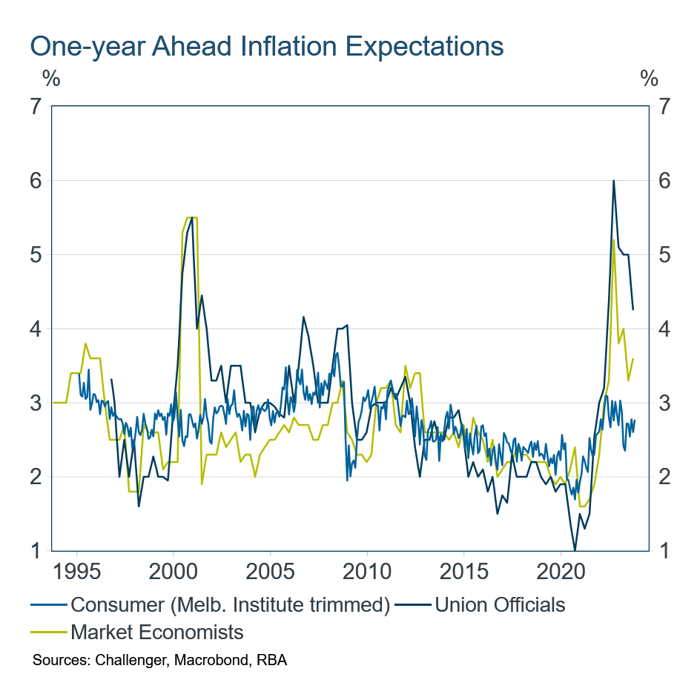

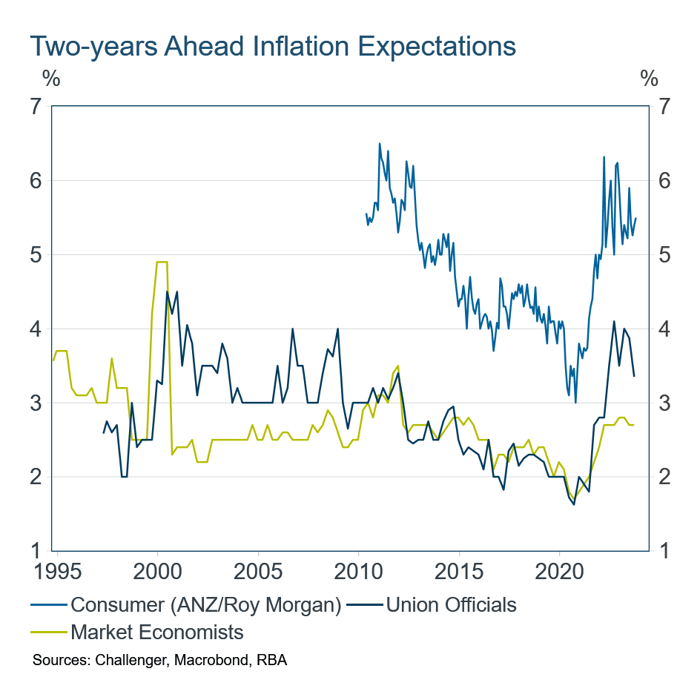

Further, survey expectations of economists, union officials and consumers have been stable or trending down in recent months (although these the economist and union surveys are only available quarterly).

While only breakeven inflation rates have increased in the past month, and that could be due to factors related to bond markets (such as liquidity), all measures of inflation expectations are well above their historical averages. The differences from average are smaller for long-horizon expectations than for short-horizon expectations. But it is still important that tight monetary policy slows inflation, and inflation expectations, to target in a reasonable timeframe. It is an open question as to whether the current setting of policy is sufficiently tight.

Jonathan Kearns Biography

Jonathan Kearns is Chief Economist and Head of Regulatory Affairs at Challenger, where he also sits on the investment committee.

He worked for 28 years at the Reserve Bank of Australia, occupying a wide range of senior roles, including Department Head for Domestic Markets Department, Financial Stability Department, Economic Analysis Department and Economic Research Department. He also led the Bank’s work on climate change across four departments.

Jonathan also worked at the Bank of International Settlements in Basel. He has published research in the fields of international finance and macroeconomics. He has a Ph.D. from Massachusetts Institute of Technology and Bachelor of Economics (Honours) from the Australian National University.

Related content

How bad are recessions for asset returns?

Is inflation higher for some households?