Signup for Tech News

Register to receive technical updates on retirement income and aged care advice from the Challenger Tech team.

When determining clients’ eligibility for the Age Pension we consider, among other criteria, their assessable income and assets. Clients’ assessable income and assets are applied against the relevant income and assets thresholds and income and assets above these thresholds reduce Age Pension at the relevant rate. The means test producing the lower Age Pension entitlement determines the rate of Age Pension payable.

The income test

The income test generally assesses most types of income, including deemed income from financial investments.

Assessable income above the relevant income test threshold reduces Age Pension by $0.50 per dollar.

The assets test

The assets test generally assesses the market value (less any debt secured against the asset) of all assets. Exemptions include the principal home, certain income streams (or a portion of the income stream) and super accumulation interests before Age Pension age.

Assessable assets above the relevant assets test threshold reduce Age Pension by $3 per fortnight (or $78 per annum) for each $1,000 of assessable assets.

Interaction between the income and assets tests

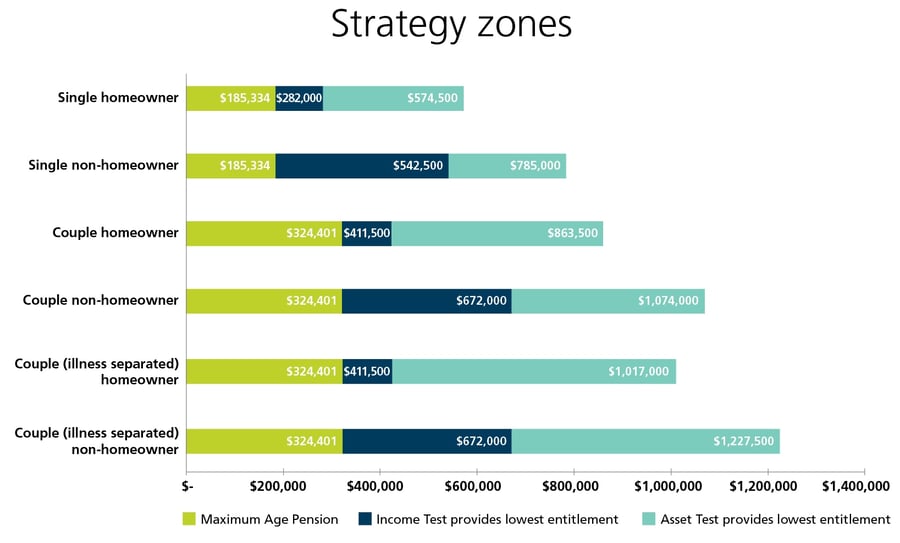

It is important to understand the interaction between the income and assets tests. A quick snapshot of Age Pension eligibility and the dominant means test determining the rate of Age Pension payable is provided in the following chart.

Age Pension income and assets test strategy zones

Assumes rates and threshold effective 20 September 2019. All assets are financial investments and subject to deeming.

The strategy zone chart shows the various categories of Age Pension recipients including singles, couples and illness-separated couples and includes both homeowners and non-homeowners of each category.

The figures shown are a guide based on the assumption that all assets are financial investments and there is no other income.

The chart shows for each category, whether at different asset levels, a client is likely to be eligible for:

- the maximum rate of Age Pension (shown in green);

- a part Age Pension - reduced because of the income test (shown in blue);

- a part Age Pension - reduced because of the assets test (shown in turquoise); or

- a self-funded retiree (with assets above the level indicated by the end of the turquoise bar).

Through retirement, eligibility for part or full Age Pension can change based on changing income and assets over time and indexation of Social Security rates and thresholds.

Why strategy zones?

Perhaps the most useful aspect of this chart is the way it quickly highlights the areas in which advice strategies could improve Age Pension outcomes.

Clients in the income test strategy zone, for example, could benefit from strategies which reduce assessable income for social security purposes. A strategy such as investing in an insurance bond via a discretionary trust from which a client made no withdrawals could be one such strategy. Every dollar a client reduced in assessable income in this zone would increase their Age Pension by $0.50.

Clients in the assets test strategy zone, for example, could benefit from strategies which minimise assessable assets for social security purposes. Every $1,000 a client reduced in assessable assets in this zone would increase their Age Pension by $3 per fortnight, or $78 p.a.

Using a lifetime income stream to improve Age Pension outcomes

Where a lifetime income stream meets the Capital Access Schedule in the SIS Regulations (introduced as part of the “Innovative Superannuation Income Streams” Regulations), just 60% of any investment will be assessed as an asset until age 85, subject to a minimum of five years. After this, the assessment reduces to 30% of any investment for the rest of the person’s life.

Where an asset test sensitive client invests $100,000 in a lifetime income stream, assessable assets immediately reduce by $40,000 (where just 60% or $60,000 is assessable). This reduction in assessable assets has the effect of immediately increasing the Age Pension by $3,120 (40 x $78 p.a.) or 3.12% in the first year.

In this current low-rate environment this additional strategic return can be significant and can allow a client to reduce, by this same amount, drawings on retirement assets. The result of which may help to sustain clients for longer in retirement.

For additional information, tools and resources, including access to the Challenger Age Pension Illustrator, speak to your Challenger BDM or call Adviser Services on 13 35 66.

Important Information

This information is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 for licensed financial advisers. It is not intended to be financial product advice or legal advice and should not be relied upon as such. Examples are illustrative only and should not be relied on by individuals when making investment decisions.

Related content

Sequencing risk explained

A resilient portfolio is different in retirement

Tools and resources for advisers

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.