Designing an intelligent and scalable retirement income solution

Part 1: The role for protection strategies in balancing flexibility with capital protection.

High inflation erodes how much a retiree can purchase with a given amount of money and so erodes their standard of living. The harmful effects of inflation will be greater for retirees whose income does not increase with higher inflation, and less for those whose income is indexed to inflation. Income from financial assets typically responds only slowly, if at all, to higher inflation and so self-funded retirees are more exposed to high inflation than retirees on Government pensions which are indexed to inflation.

Australia’s recent inflation experience

The current high inflation episode starkly demonstrates the cost of inflation. Inflation in Australia unexpectedly surged from early 2021 against a backdrop of strong demand with the end of pandemic restrictions, disruptions to supply chains and Russia’s invasion of Ukraine increasing oil prices. Despite the Reserve Bank of Australia (RBA) increasing interest rates sharply, inflation peaked at 8% in Australia, with even higher rates seen in some other countries.

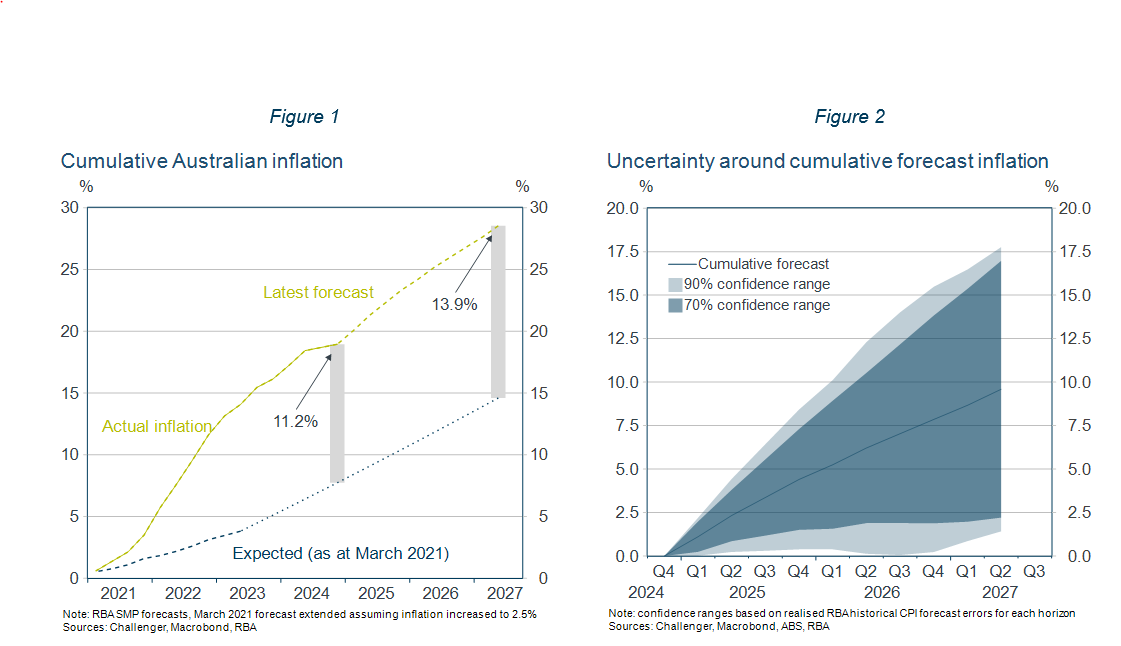

Focusing on inflation at a point in time understates the cost this sustained episode of inflation has had on retirees’ purchasing power. Since inflation accelerated in early 2021 the cumulative increase in prices, as measured by the CPI, has been just under 20%. The RBA targets inflation of 2.5% but back in early 2021 was forecasting inflation to undershoot this target over the subsequent years.

Since the start of 2021 realised cumulative inflation has been 11% above expected inflation (Figure 1). In other words, an investor holding assets that don’t compensate, directly or indirectly, for unexpected inflation will have had the purchasing power of their capital eroded by 11%. A lower inflation-adjusted capital base significantly reduces a person’s ongoing real wealth and quality of life.

Inflation is only slowly returning to more normal levels and is expected to be above 2.5% for much of the time through to the end of 2026, adding to the cumulative excess inflation of this high inflation episode. By the end of 2026, inflation will have been above the 2.5% mid-point of the RBA’s inflation target for almost all of the previous five years and cumulative inflation, in excess of projections in early 2021, is expected to be around 13.5%.

Uncertainty about inflation

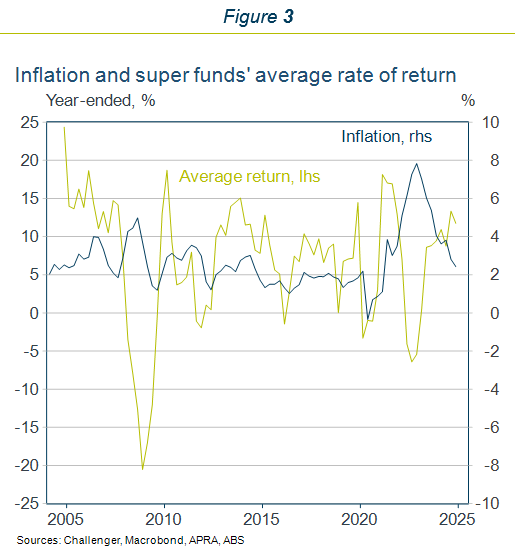

There is always significant uncertainty about future inflation. The RBA’s forecasts imply that cumulative inflation from the December quarter 2024 out to mid 2027 will be almost 10%. Using the RBA’s historical forecasting errors to construct standard errors around this projection, as the RBA does for its forecasts, highlights just how large the uncertainty is for inflation over the coming period. Indeed, there is a 70% chance that cumulative inflation until mid 2027 will be somewhere between 2% and 17% (Figure 2). That is a very high degree of uncertainty.

Hedging inflation

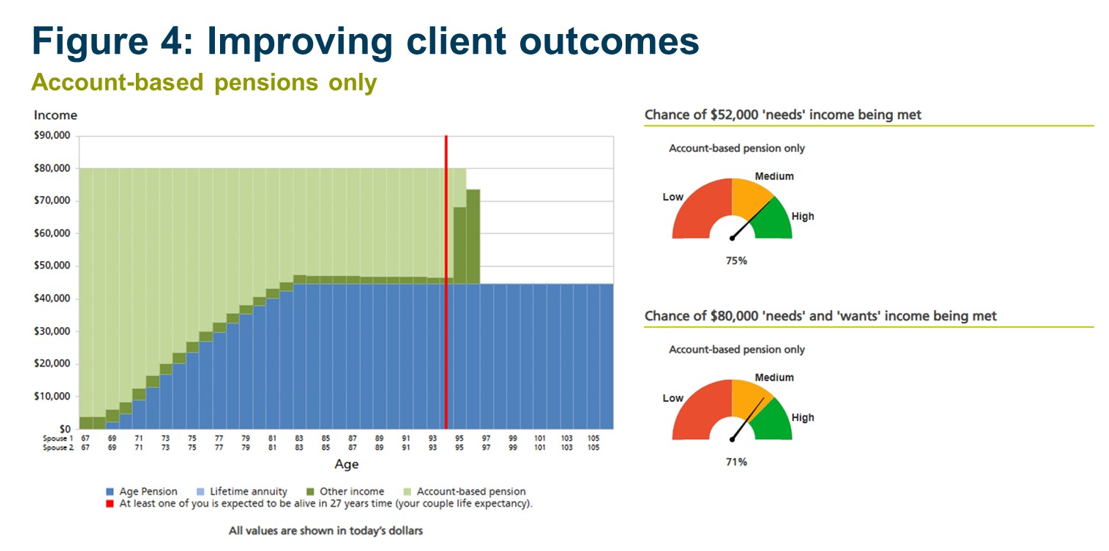

The protection that assets provide against inflation depends on how their current and future income streams, and capital base, respond to higher inflation. Defensive assets tend to have little protection against inflation. Fixed income assets are the most exposed to inflation as neither the interest payments or capital base increases with inflation. Variable income assets provide some compensation, if interest rates increase sufficiently. But as the recent episodes demonstrates, often they do not. Growth assets will tend to provide some protection to inflation, but even then an increase in divends and capital values can significantly lag inflation. Drawdowns to fund retirement income before that occurs can then significantly erode the real value of retirement savings. The other consideration is that episodes of high inflation often correspond with higher interest rates and a downturn in growth, as well as other shocks, which can reduce growth assets’ value. In the past two decades, superannuation has provided negative returns in the two episodes when inflation spiked (Figure 3).

Recent research into Australians’ retirement needs highlights that inflation and cost-of-living pressures are impacting both pre-retirees and retirees with 55% of surveyed retirees expressing concern. This, in addition to health concerns, makes fewer Australians feel ready for retirement and put retirement plans under pressure in 2024.

While the Age Pension keeps pace with the cost of living, not all members will be eligible for the Age Pension while, for other members, the Age Pension alone will be insufficient to meet their essential retirement spending.

Hence, to address members’ concerns and help build confidence, it is prudent to offer members an income stream that helps retirement income keep pace with the cost of living.

A CPI-linked lifetime income stream, used in combination with an account-based income stream, can help members to:

- Improve the certainty of retirement income keeping pace with changes in inflation;

- Ensure that essential expenses can be met (in real terms and for as long as a member lives) through a combination of CPI-linked Age Pension and CPI-linked lifetime income;

- Increase the total level of income in retirement (from all sources); and

- Improve total portfolio and estate outcomes.

The following case study demonstrates how a packaged combination of account-based pension and guaranteed CPI lifetime income can help members solve for a real level of retirement income over a lifetime.

Case study:

Beth and Steve are a 67-year-old couple. They own their own home. They have recently finished work (this time for good). After some recent rebalancing of their super balances between them, they have $500,000 each in super. They are looking to commence pensions from their fund. In addition, Beth and Steve have $100,000 in cash and term deposits and $50,000 of non-financial assets.

Beth and Steve want to live ‘comfortably’ in retirement. They have worked out their ‘essential’ level of retirement spending and they believe that they need $52,000 p.a. to meet their ‘non-negotiable’ spending. But, to live their version of ‘comfortable’ they want to spend $80,000 p.a. (including their essential spending) so they can ‘live well’ in retirement.

Beth and Steve need this amount to keep pace with the cost of living over their retirement. They have both seen the cost of things like groceries, a visit to the doctor, gas and electricity and a range of other ‘essentials’ increase dramatically over the past few years.

A ‘comprehensive’ income stream

A comprehensive income stream (‘blended solution’), made up of 80% of member benefits moving to an account-based pension and 20% of assets into a guaranteed CPI-linked lifetime pension could significantly improve retirement outcomes for a member couple like Beth and Steve.

The allocation to the account-based pension provides income flexibility each year (above the minimum payment) and flexible access to capital if required. The 20% allocation to a ‘CPI-linked lifetime pension delivers guaranteed income, payable for life, linked to the cost of living. The combination of the income from Beth and Steve’s Brighter Super pensions, interest from their cash and term deposits and income from the Age Pension provides secure and diversified income for retirement.

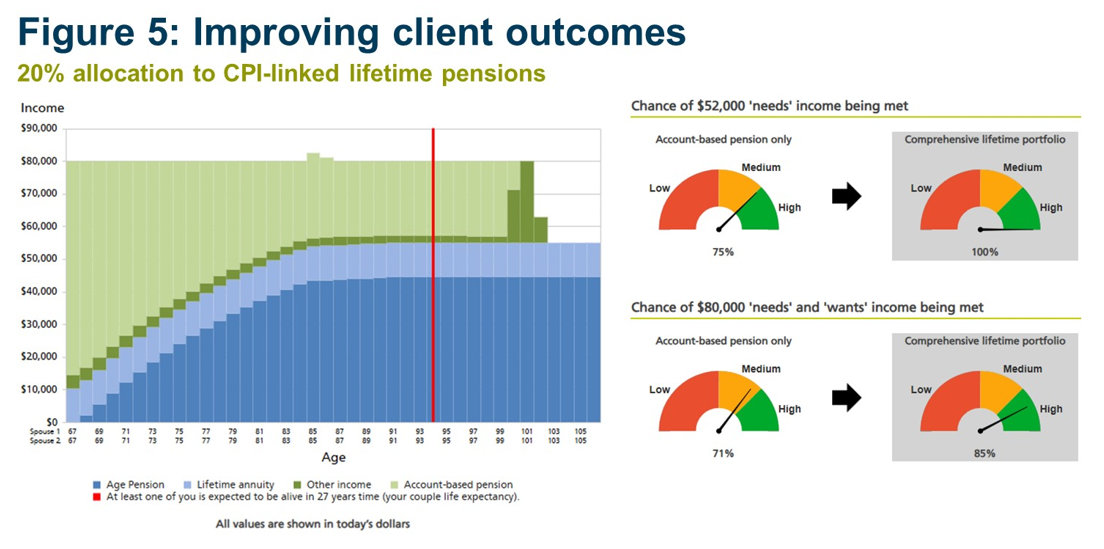

Figure 4 below shows the income solely coming from an account-based pension. This approach does not protect against inflation, investment, or longevity risk.

Source: Challenger Retirement Illustrator (14/02/2025) using Social Security rates and thresholds effective 1 January 2025. 67-year-old male/female client couple. $500,000 each in super. Deterministic analysis assumes returns of 4.0% p.a. for defensive assets and 8.0% p.a. for growth assets before fees. $100,000 cash/TDs earning 4.0% p.a. interest. Non-financial assets of $50,000. $80,000 p.a. desired income including $50,000 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions. Reference number: RIC250214000700.

Figure 5 below shows the income from a comprehensive income stream with a combination of account-based pension and guaranteed CPI-linked lifetime income.

Source: Challenger Retirement Illustrator (14/02/2025) using Social Security rates and thresholds effective 1 January 2025. 67-year-old male/female client couple. $500,000 each in super. Deterministic analysis assumes returns of 4.0% p.a. for defensive assets and 8.0% p.a. for growth assets before fees. $100,000 cash/TDs earning 4.0% p.a. interest. Non-financial assets of $50,000. $80,000 p.a. desired income including $50,000 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions. Reference number: RIC250214000700.

Relative to an account-based pension alone and a blended solution comprising of an account-based pension the comprehensive retirement income stream delivers Beth and Steve:

- Lifetime income for as long as they live starting in the first year at $10,512 p.a. And fully protected against the change in the cost of living over time;

- A 100% chance of meeting (non-negotiable) income ‘needs’ (an increase of 25% over the non-lifetime portfolio);

- An 85% chance of meeting ‘needs and wants’ (an increase of14% over the non-lifetime portfolio);

- Estate value increased by $91,712 (in today’s dollars) at the couple life expectancy; and

- The total retirement income over the couple life expectancy is $3,561 higher.

A comprehensive income stream (‘blended solution’) that is comprised of an account based pension and a guaranteed CPI linked lifetime income can deliver members improved retirement outcomes, manage effectively the risks in retirement, including inflation, investment, and longevity risk, and, importantly build members’ confidence for their retirement.

Related content

Defined Benefit de-risking

Financial wellbeing and rising costs of living