Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

Part 1: The role for protection strategies in balancing flexibility with capital protection.

Global pension funds continue to explore investment approaches to deliver retirement solutions that meet the needs of their members and beneficiaries to and through retirement. This article is the first in a series of two exploring some of the approaches from different pension systems around the world.

Fund members want to get the most out of their super in retirement, but members do not always know the optimal investment solution for their retirement needs. The super industry has done a good job in getting members to understand the value of a long-term investment strategy in accumulating savings, but retirement is different. Members not only need fit for purpose solutions for retirement, they also need a pathway to get them from their accumulation phase to their retirement solution. Funds will need an approach that has the scale to deliver the pathway for each of their members. In the UK, some pension funds are using pathways that vary the amount of flexibility and certainty that is provided to members through retirement. This includes:

- Flexibility of investment choice and access to capital in early retirement

- Reduced flexibility and limited access to capital to provide a stable income

- Limited flexibility in later retirement to manage longevity risk without a need for capital access.

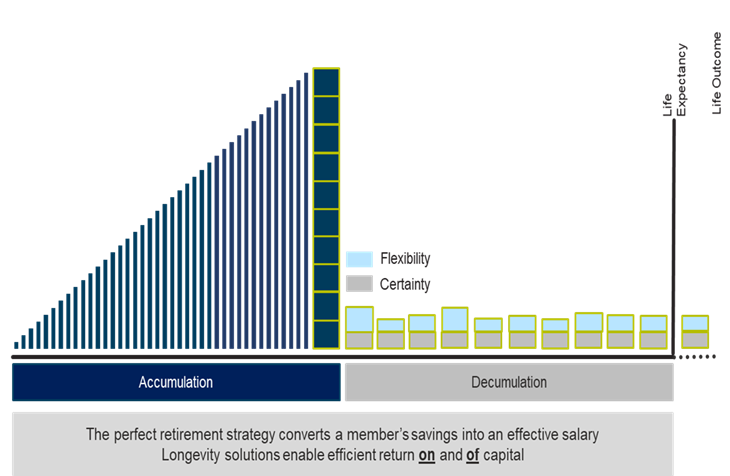

Retirement income: a mix of flexibility and certainty

A fundamental starting point in designing and implementing an effective retirement income strategy is to recognise that financing retirement is different to accumulating savings. An accumulation portfolio benefits from cash inflows and long-term investment returns with the aim of maximising the capital available for retirement. In retirement, the focus needs to shift from capital to the income that can be generated for the retiree. This is not a matter of creating an income yield from the capital, but rather converting the capital into an income stream, or in other words, delivering the return 'on' and 'of' capital. Ideally, the income stream will match the spending requirements of the retiree. This will involve some income delivery with certainty and other income than can be drawn and spent with full flexibility. With the number of variable factors in a retirement portfolio, flexibility is an important element of any design.

Delivering flexibility and certainty requires a wider breadth of investment techniques than might be employed for an accumulation portfolio. A combination of guaranteed and non-guaranteed income exposures can solve for these objectives. There are two complementary investment approaches in addition to adjusting risk profiles that can meet these goals. The first is the use of protection strategies, and the second is Asset-Liability Management (ALM). The rest of this paper considers protection strategies and ALM will be the main topic in a later paper.

Protection strategies: benefits and application

Incorporating protection strategies allows retirees to maintain investment exposures and manage sequencing risk during the early stages of retirement, while providing retirees with flexible access to their capital. Protection strategies can be delivered as funded building blocks, such as capital protected asset classes. However, using an overlay solution has the potential to offer greater flexibility and can adapt to changing market environments. Overlay strategies typically involve less interference with the underlying portfolio management strategy and they can be customised to protect different asset allocation mixes.

Objective: Maintain flexibility with low chance of capital loss

A key benefit of protection strategies for the first phase of a decumulation glidepath is that they can be tailored to protect or reshape return distribution to target a desired profile. Most importantly, they can substantially reduce the probability of large losses.

The returns in an investment portfolio often have a negative skew. For a retirement portfolio where there are capital drawdowns, the impact of market falls can be magnified. Simply using a more conservative asset mix doesn’t eliminate the negative skew. Ideally, a protection strategy should be able to offset the negative skew in the underlying return distribution. This might be described as convex to the downside. For example, a put option overlay can be an effective protection strategy to transform the shape of the return distribution by reducing the left tail.

Adjusting asset allocation to lift expected returns

While the protection strategy suppresses the left side of the distribution, this usually comes at the cost of lower expected returns overall. To offset this impact, a second part of the strategy is to increase exposure to alternative sources of value-add in the investment portfolio, shifting return distribution back to the right.

If the additional source of value-add is uncorrelated to the rest of the portfolio, it can reduce overall portfolio volatility and tighten the return distribution. Potential sources include a funded structured solution that pays a specified margin, or an unfunded strategy to complement the underlying portfolio, such as a diversified alternatives overlay.

Helping the transition from accumulation to decumulation

An overlay protection strategy can help retirees with a smooth transition from late-stage accumulation to decumulation. The only portfolio adjustments required are the addition of protection overlay and reassessing asset allocation of the overall portfolio after the implementation of the overlay.

In the next article we’ll look at the second investment strategy – Asset and Liability Management (ALM) – and how it can be applied to a portfolio to balance income stability and longevity protection in the retirement phase.

Related content

Capital Preferences roundtable outcomes

Financial wellbeing and rising costs of living