Designing an intelligent and scalable retirement income solution

Part 1: The role for protection strategies in balancing flexibility with capital protection.

Australia’s superannuation system excels at accumulating savings, yet it falls short on helping Australians convert those savings into a reliable income in retirement.

The Mercer-CFA Institute Global Pension Index reflects this gap, with our attitude to retirement income as an optional extra seeing us slip down the retirement ranks.1 With Treasury focused on best practice principles for superannuation funds and 250,000 Australians set to retire every year, the need for high-quality retirement income solutions is critical.

Creating a retirement income solution is like crafting a good recipe: it needs the right mix of ingredients to suit diverse tastes. As an industry, it’s our responsibility to play host and serve up a retirement feast that allows every Australian to delight in their golden years.

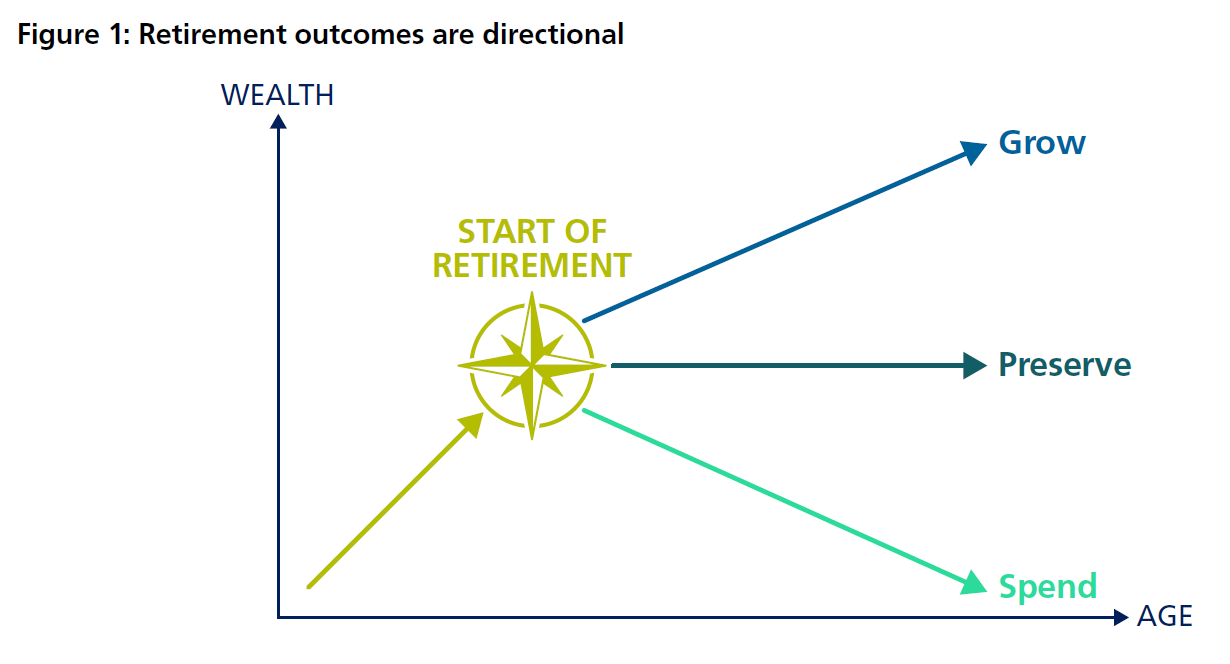

Retirement is the time when people can draw from savings without needing to work for income, so the rate of capital consumption matters. While it is possible to preserve wealth, or even grow it, during retirement by limiting spending, the primary objective for superannuation is to provide income through retirement, not to maintain or accumulate capital. This doesn’t stop people who want to ‘have their cake and eat it too’ to preserve some wealth from using superannuation as a tax-effective vehicle if it aligns with their goals. However, the overarching purpose of superannuation, guides superannuation funds (funds) to help members spend down savings to maximise income.

To deliver the highest-quality retirement outcomes, here’s a recipe for success.

1. The host with the most

Planning for retirement is like preparing for a grand feast—knowing where to start can be the hardest part. It’s like walking into a kitchen full of ingredients, unsure which recipe to follow first. Unfortunately, many members feel the same when they ask for help on retirement. The good news is, funds can act as skilled hosts, offering a “Start Here” guide that considers what’s already known about each member.

To play host, we need to better utilise existing data and systems. The Delivering Better Financial Outcomes reforms should enable funds to provide more assistance. Importantly, funds are not required to know everything about their member to help. Cameos and cohorts can provide a range of ‘people like you’ – simple, adaptable menus retirees can easily follow. For instance, if a fund isn’t certain whether a member owns their home, they can present tailored options based on reasonable assumptions.

2. Curate the menu

Once you know your way around the kitchen, it’s important to know what will be on the menu. The same can be said for retirement. The first step to better retirement outcomes is shifting the focus from account balances to income projections. By looking ahead, the member can see what they need in retirement and begin to plan. Members should receive annual income projections as well as, or instead of, a balance projection. It’s far easier to relate to a lifestyle of $50,000 a year than to interpret a $600,000 balance. Funds have the expertise and tools available to do this on scale for their members.

Guidance should begin early and evolve over time. Automating timely nudges can make a significant difference. For example, if a member’s contribution increase indicates a promotion, the fund could highlight how their retirement income might benefit from additional contributions. By showing retirees what’s on the menu and breaking it down into manageable steps, funds can help build members’ readiness for retirement, keeping the focus on income and reducing the pressure of major decisions at retirement.

3. From entrée to dessert

Retirement income solutions should account for the full financial picture – from entrée to dessert. The objective of superannuation is ‘to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way’.2 This sounds complete, but as the Retirement Income Review noted, there are more ingredients to generating income in retirement.

Government support includes the Age Pension and members might also have savings outside of superannuation. If a super fund is providing a solution for a member’s retirement income, it must consider the potential impact of external components.

4. Income, is the hero for retirement

We’ve planned the menu, now it’s time to deliver the flavour. Maximising retirement income is the ultimate goal and should be the hero of the dish that is served up. While members’ best financial interests usually focuses on fund expenses, the real measure of success is the income members enjoy in retirement.

There are constraints to manage. A fund’s income solution must provide more value than it costs, but it doesn’t have to be individually tailored for every member. Some high balance members might benefit from the additional tailoring, but the role of a superannuation fund trustee is to meet the collective needs. Funds can support members by providing access to quality financial advice without draining the collective resources of other members. This can help members to find a suitable, high-quality retirement income solution.

5. Blending the herbs & spices

The right mix of herbs and spices can take the dish to the next level. To deliver a high-quality retirement income solution, this means a blend of:

- Growth investments to support income in later years by growing capital, with some volatility;

- Stable assets, that will maintain capital with some income and flexibility; and

- Lifetime income streams that ultimately convert the committed capital to income that lasts throughout retirement.

While some retirees will have specific dietary requirements, funds should have each of the core ingredients available to meet members’ varying needs.

6. Trust the Chef

While wealth accumulation looks the same for most Australians, a more customised approach is needed for the retirement phase of superannuation.

Without guidance, retirees might struggle to combine the right financial ingredients, risking an outcome that doesn’t meet their needs. The Chef’s Menu pairing guides retirees to the right flavour combinations.

For example, a simple menu might suggest: 50% in growth investments; 25% in stable liquid investments; and 25% in a lifetime income stream. Retirees can then adjust this base to suit their personal tastes, ensuring the plan reflects their unique preferences and goals.

While some retirees are confident experimenting, others may prefer to “trust the chef”, relying on their fund or seeking out a financial adviser to design a bespoke solution. Ideally, funds would help members access this advice, in addition to providing good base options.

7. Consider BYO

The right wine can bring a meal together. BYO allows members to pair the menu with a vintage that suits them best. Funds must account for members who bring their own financial accompaniments to the table.

For example, where a member’s partner has a reversionary defined benefit pension, adding another lifetime income stream might be unnecessary. Alternatively, someone might have a string of investment properties or other assets outside of super. A fund might not be aware of these components, but retirement income solutions need flexibility to ensure there is no double-up.

8. Retirement is the dessert of life — enjoy it

Is there anything better than a sweet treat at the end of a meal? Retirement is the dessert — retirees have earned it, now they should enjoy it. Superannuation savings are your carefully crafted mille-feuille - a creation that’s not only beautiful to look at but meant to be savoured. The key question for retirees is: Do they enjoy those sweet savings now or preserve it?

The objectives of the Retirement Income Covenant are clear on this - retirees should consume it. It is the only way to maximise income through retirement, as trustees must help their members do. Planning to leave something behind is easy, but it means underspending and reduces the efficiency of the whole system.

Converting accumulated savings to income to spend is the sweetest finish. A well-designed income solution ensures retirees can relish their dessert guilt-free, knowing it will last the entire course of retirement.

9. Let the chefs work their magic

Retirement planning is more than generating income. Good estate planning and wealth management (the grow and preserve paths in figure 1) are both relevant to retirement but should not be part of a fund’s retirement income solution. The best practice for a fund is to focus on the provision of retirement income and allow financial advisers, estate lawyers and others to manage these goals for their members.

Retirement should be a golden time in life. Superannuation funds, and the broader industry, have an important role to play in serving up the best meal yet for their members. We have the right ingredients, with a world class accumulation system, but we must curate the menu to ensure we don’t miss out on the most crucial component – converting those savings into a reliable income that lasts, for life. Afterall, we should always save room for dessert.

1 Mercer CFA Institute Global Pension Index 2024

2 Superannuation (Objective) Bill 2023 – Parliament of Australia

Related content

Defined Benefit de-risking

Financial wellbeing and rising costs of living