Thinking alternatively - Part one

Alternative investments include a broad spectrum of investments, spanning different asset classes, investment styles, fund structures and liquidity profiles. Different types of alternatives can also have different risk profiles. For example, a macro hedge fund is different to a venture capital fund, which in turn is different to an infrastructure fund. One isn’t necessarily better (or worse) than the others, and all can serve a valuable role in an investment portfolio. After all, the whole point of a portfolio is to have exposure to more than one thing.

In this series we seek to lift the veil on the sometimes-opaque world of alternatives investing. The universe of alternatives is broad and diverse, so it is important to understand that different alternative investments can provide very different benefits and come with different kinds of risks.

We explore how investors can use alternatives to build more resilient portfolios by broadening their opportunity set, achieving better risk-adjusted returns, and potentially limiting portfolio drawdowns during periods of market stress. We will introduce alternatives and summarise some of the benefits, risks and other considerations across the universe of alternatives. We aim to expand on some of the concepts introduced here in future articles.

What are alternatives?

A simplistic definition of alternatives is ‘anything that isn’t equities or fixed income’, however, this is incredibly broad, and we also think it is important to understand that the ‘alternativeness’ of an investment does not derive purely from the nature of the underlying asset class. A different investment approach within an asset class can also be an effective alternative investment. We therefore prefer ‘investments that deliver uncorrelated returns’ as a definition for alternatives. That is still quite broad, but brings us closer to the ultimate purpose of alternatives investing, namely, to enhance overall portfolio returns by increasing portfolio diversification.

We sort alternative investments into five broad categories:

- Hedge Funds

- Private Equity and Private Credit

- Real Assets (e.g property and infrastructure)

- Commodities

- Collectibles

Each of these can have very different characteristics and can play different roles in a portfolio. Similar to investing in the share market, we think there can be value in investing in several different alternatives. Diversifying not only amongst the broad categories outlined above, but also across different styles within each category can lead to more consistent overall outcomes.

According to Nobel Prize laureate Harry Markowitz, diversification is the ‘only free lunch’ in investing. We think this is the single most important aspect of alternatives. Investors can increase the diversification of their portfolios by looking beyond traditional asset classes and investment styles. Investing in alternatives provides a different type of return stream that can complement an existing portfolio.

Why invest in alternatives?

Investors derive diversification benefits when the components of their portfolios are different to each other. While investors can gain some diversification within the share market by investing across different stocks or sectors, a downturn or risk off event can nevertheless impact the market at large. Since many of the drivers of equity performance are the same for different stocks – for example the economic cycle, interest rates and broad risk premiums - the overall diversification benefit is reduced.

Adding non-equity exposures can build more resilient portfolios. Traditionally, fixed income has served an important role in this regard, providing stable returns over time as well as some defensive benefits. The classic ‘60/40’ balanced portfolio consists of equities and fixed income for this very reason.

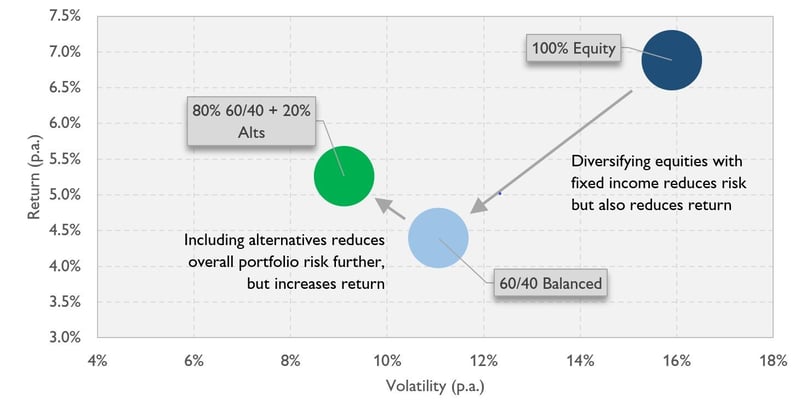

By including investments beyond stocks and bonds, investors can potentially reduce portfolio risk and enhance overall returns even further. Given alternatives can have low or even negative correlation to stocks and bonds, the diversification benefits can be significant. As an illustration, the chart below shows how the risk/return profile of a portfolio can be improved through the inclusion of alternatives in a portfolio.

Figure 1: Diversification benefits of alternatives. Historical returns and volatility are calculated using quarterly data from December 2013 until March 2023. Equity is MSCI ACWI Net Total Return USD, Fixed Income is Bloomberg Global Aggregate USD, and Alternatives is an equally weighted portfolio of Bloomberg All Hedge Fund, Bloomberg Buyout Private Equity and Bloomberg Real Asset Private Equity.

Alternatives can also be used to reshape the return distribution of a portfolio. Objectives such as overall return targets (the median return in the distribution), risk tolerance (the volatility of returns), drawdown limits (reducing the tails of the distribution) and defensiveness (the covariance of the returns against traditional assets) are some of the ways in which the return distribution of a portfolio can be transformed using alternative investments.

Considerations and risks with alternative investing

Higher correlation reduces the diversification benefits and may impact the rationale for the alternative investment in question. Even where historical returns have been uncorrelated, there may be some situations where correlation can be higher.

Understanding in advance the circumstances when this might be the case is important when selecting an alternative investment. For example, some investments may exhibit high conditional correlation, for example, during periods of market stress. In such instances it may turn out that a particular alternative investment does not provide the desired diversification or level of defensiveness when it is most needed.

In general, it is important to understand which factors might drive returns for any given alternative investment, and where (and when) those might overlap with equities or other existing portfolio holdings. Where similar factors can reasonably be expected to drive both, care should be taken not to rely too heavily on the diversification benefit. Listed and private equities, for example, have similar risk factors such as their exposure to the economic cycle. Whereas some hedge funds may be less exposed to the market cycle as they focus on relative value between assets and asset classes. An investment might still provide some other benefit (e.g. different or higher expected returns) that makes it an attractive substitute for an existing investment. However, being aware of the circumstances where the return profile may turn out to be similar to existing exposures will help ensure the alternative investment is fit for purpose.

Liquidity is another consideration. Some alternative investments, such as Private Equity and Private Credit, can require investors to lock up capital for many years. Others, such as Hedge Funds, might only provide quarterly or monthly liquidity. Therefore, the liquidity requirements for a portfolio need to be well understood to make the right trade-offs between different types of alternative investments.

Similarly, the need for a portfolio to produce a certain level of income may be a factor, and investors may need to consider which types of alternative investments can provide this. This is especially true for alternatives because liquidity constraints may impact an investor’s ability to convert other types of return (e.g. unrealised capital gains) into an income stream by partially selling down a holding.

Figure 2 below outlines some of the main characteristics of different types of alternatives.

Figure 2: Comparing traditional and alternative asset characteristics

| Asset class | Public/Private | Liquidity | Return expectation | Risk category | Main risk factors |

|---|---|---|---|---|---|

| Listed Equity | Public | Liquid | Medium - High | Medium - High | Economic cycle, inflation, equity |

| Fixed Income | Public | Liquid | Low - Medium | Low - Medium | Economic cycle, inflation, interest rates, credit |

| Hedge Funds | Private | Limited liquidity | Medium - High | Medium | Style risk, leverage |

| Private Equity & Credit | Private | Liquid | High | Medium - High | Economic cycle, inflation, leverage, equity/credit risk premium |

| Real Assets | Private | Limited liquidity | Medium | Medium | Economic cycle, inflation, interest rates, credit risk premium |

| Commodities | Public | Liquid | Low | Medium - High | Economic cycle, inflation, technology shifts/supply shocks |

| Collectibles | Private | Limited liquidity | Low - Medium | Low - Medium | Inflation, change in preference |

Final thoughts

Diversification is the major benefit of alternatives, and even within the alternative investment universe, we think investors will benefit from having several different exposures. As such, understanding how various types of alternative investment differ to each other is important in figuring out the best ways to include them in portfolios.

We believe alternative investments can play an important role in helping investors build more resilient investment portfolios. Strong diversifying qualities, along with the unique exposures alternatives provide, can help investors reshape their overall portfolios to increase the probability of achieving a desired investment outcome.

This material has been prepared by Challenger Investment Solutions Management Pty Ltd (ABN 63 130 035 353, AFSL 487354) (CISM or the Investment Manager), the investment manager of the Fund. Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Fund. The information in this material should be regarded as general information only and is not intended to be financial product advice. It has been prepared without taking account of any person’s objectives, financial situation or needs. Spectrum is only currently available as an institutional class investment.

Past performance is not a reliable indicator of future performance. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.

Related content

.png?h=325&iar=0&w=500)

Correlation and the power of diversification

.png?h=325&iar=0&w=500)

Different alternatives achieve different things

.png?h=325&iar=0&w=500)