Thinking alternatively - Part four

Introduction

We are strong believers in the value of diversification in investment portfolios. Historically, fixed income has been viewed as an effective portfolio counterweight to more growth-oriented equity allocations. However, it’s worth remembering that a secular bull-market for bonds from the early 1980s until the COVID-induced lows in yield in 2020 – a period encompassing the vast majority of investors’ experience – has been a strong tailwind for fixed income allocations, and there’s no guarantee that will persist. In 2022, for example, both bonds and equities posted double-digit losses, and investors who relied solely on fixed income to diversify their equity holdings had a sorry time of it that year.

While fixed income can undoubtedly serve a role in a diversified portfolio, we believe additional diversification should be sought from elsewhere. This is where alternative investments come in. In Thinking alternatively - Part three we identified four main use cases for alternative investments, namely: diversification, boosting returns, defensiveness and macro exposure management. Diversification is arguably the most important of those, however, we believe it is often under-appreciated.

We believe the key elements of a successful diversifying alternative investment are consistent (not lumpy) returns and consistently low correlation. Investments which deliver short bursts of outsized returns, or which exhibit high variability in correlation, are less reliable diversifiers.

A diversifying alternative can have the following benefits:

- Deliver positive investment returns in up, down and range-bound markets.

- Reduce overall portfolio volatility.

- Enhance risk-adjusted portfolio returns.

- Reduce portfolio drawdowns.

Diversification benefits

An alternative investment with low correlation to traditional betas such as equities and fixed income can serve an important role as a diversifier in most investment portfolios. To illustrate the value of a low correlation profile, figure 1 below shows the risk versus return for a 100% equity portfolio, a 100% fixed income portfolio, and a balanced '60/40' portfolio1. In all three instances, a 20% allocation to a diversifying alternative2 can potentially both decrease the risk of the portfolio and increase the return.

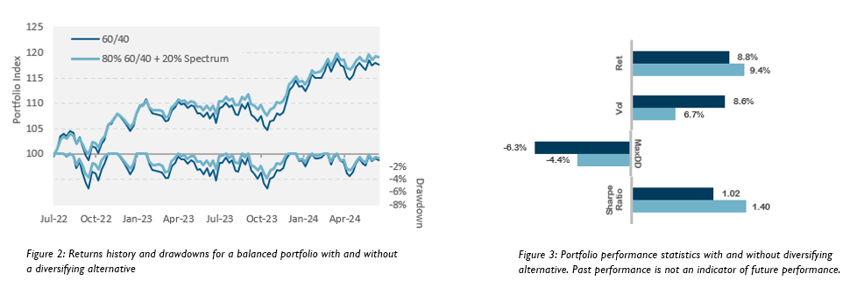

The inclusion of diversifier in a portfolio can also help to dampen portfolio drawdowns. The chart below shows the returns history of the balanced portfolio with and without a diversifying alternative. Overall, a balanced portfolio including a diversifier would have had better risk-adjusted returns with lower drawdowns over the period since July 2022.

The importance of consistent returns

Low correlation is one thing, however, ultimately a diversifying alternative needs to deliver attractive returns in order to appeal to investors. For investors seeking a diversifier, we believe consistent returns are more important than large returns.

We observe that many alternative investments that deliver large returns tend to come with higher volatility, higher risk of large drawdowns and a 'lumpy' return profile. This may be acceptable to an investor seeking to boost the returns of their portfolio, however, we think these things have the potential to undermine the diversifying qualities of such investment, and such investments may be less useful for an investor seeking to diversify their portfolio in order to reduce overall risk.

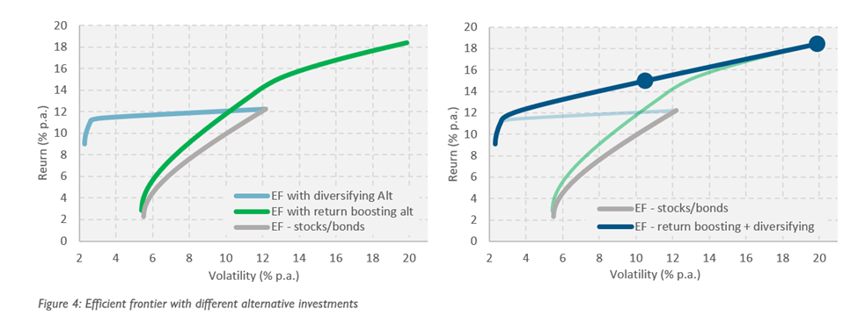

One way this can be seen is in the efficient frontier1. A high-quality diversifying alternative allows investors to access points on the risk-return curve they may not be able to otherwise achieve. In particular, the ability to achieve a higher return for less risk and lower drawdown than would otherwise be possible. This is the blue efficient frontier curve on the left-hand chart in Figure 4. A return-boosting investment allows investors to increase the overall return on the portfolio, but it comes at the expense of higher risk and higher potential for large drawdowns – the green efficient frontier on the left-hand chart.

By including both a return-boosting and a diversifying alternative, an investor can expand the efficient frontier even further. This is the dark-blue efficient frontier on the right-hand chart above. An investor whose only objective is to maximise returns might choose the far-right dot on the dark blue efficient frontier. Over the last two years they would have potentially achieved an 18.4% p.a. return with a 19.9% p.a. volatility and a maximum drawdown of -10.4%. Returns were higher, but so was risk.

An investor who is seeking a diversifier to reduce portfolio risk may prefer the dot further to the left. This portfolio includes both the return-boosting and the diversifying alternative and potentially had a 15.0% p.a. return with 10.5% p.a. volatility and a maximum drawdown of -5.8%. That compares favourably with the ASX 200 return of 12.2% p.a., volatility of 12.2% p.a. and max drawdown of -7.9%.

The role of liquidity

The ability to rebalance the portfolio regularly can be a source of return during risk-off periods, and a source of risk management during risk on periods, and therefore can be an important additional consideration when incorporating diversifying alternatives into a portfolio. Diversifying alternative investments with more frequent liquidity therefore have some additional benefits over those with less frequent liquidity.

Conclusion

A good diversifying alternative investment should have the following features:

- Low and stable correlation to traditional asset classes.

- Consistent returns through time.

- Sufficient liquidity to allow for portfolio rebalancing.

Diversifying alternatives have the ability to deliver positive returns in any market environment, reduce risk, limit drawdowns and enhance overall portfolio returns in a way few other investments can. Importantly, diversifiers can enhance the value of other, riskier, investments, and portfolios which include both return-boosting alternatives and diversifying alternatives can access points on the risk-return curve other portfolios cannot. As such, we believe diversifying alternatives should be an important part of any well-rounded investment portfolio.

1Equity is ASX 200 Total Return Index and fixed income is Ausbond Composite 0+Y Index. Returns and volatility are calculated from 14 July 2022 to 31 May 2024.

2 We use the Spectrum Systematic Alpha Strategy (Spectrum) as an example of a diversifying alternative. Returns and volatility are calculated from 14 July 2022 to 31 May 2024. Past performance is not an indicator of future performance.

3An efficient frontier shows the highest return an investor could achieve for a given level of risk given the investments available. We construct an efficient frontier using returns from 14 July 2022 until 28 June 2024, using the ASX 200 for equities, Ausbond Composite 0+Y for fixed income, Spectrum as the diversifying alternative, and a sample listed long/short equity fund as the return-boosting alternative investment.

This material has been prepared by Challenger Investment Solutions Management Pty Ltd (ABN 63 130 035 353, AFSL 487354) (CISM) for wholesale investors only. The information in this material is general information only and is not intended to be financial product advice. It has been prepared without taking account of any person’s objectives, financial situation or needs. The information in this material has not been independently verified. No reliance may be placed for any purpose on the material for its accuracy, fairness, correctness or completeness. To the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. Past performance is not a reliable indicator of future performance. Investments can be subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, neither CISM nor any of its related bodies corporate guarantees the performance of the strategy, the repayment of capital or any particular rate of return.

Related content

.png?h=325&iar=0&w=500)

Correlation and the power of diversification

.png?h=325&iar=0&w=500)