Monthly Report October 2024

Fund objective

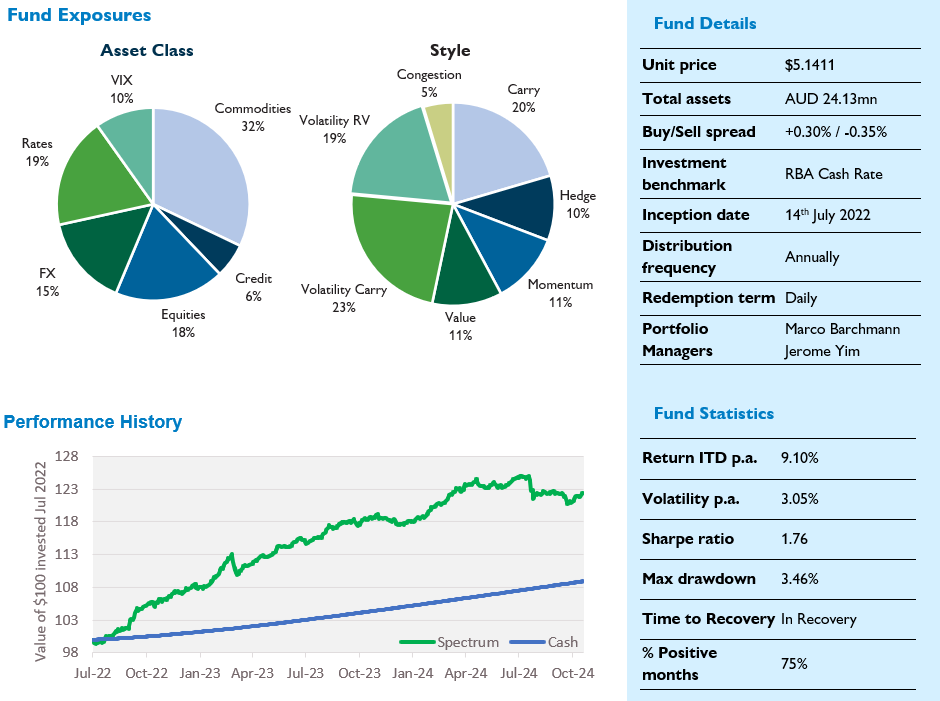

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 0.34% | -1.65% | 3.07% | 7.54% | 9.10% |

| RBA cash | 0.36% | 1.08% | 4.33% | 3.97% | 3.71% |

1 Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 October 2024

Monthly commentary

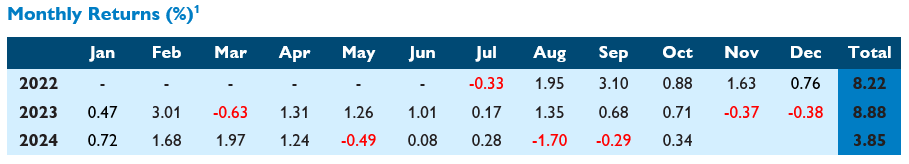

Spectrum gained a modest 0.34% in October, taking CYTD gross performance to 3.85%. Since inception, performance stands at 9.10% p.a. versus 3.71% p.a. for the Fund’s cash benchmark, an outperformance of 5.39% p.a. Annualised volatility has been 3.05% over the same period, for a gross since-inception Sharpe ratio of 1.76.

Following three consecutive months of negative performance, our Commodity strategies posted a modest recovery in October. Commodity Value (+0.22%) Commodity Congestion (+0.14%) and Commodity Carry (+0.13%) were up, while and Commodity Vol (-0.08%) was modestly lower. Elsewhere FX Carry (+0.10%) also recovered some of the recent losses, while Rates Trend (-0.46%) and Rates Vol RV (-0.12%) were the other weak spots.

Given the recent run of underperformance and the proximity of the US election, we’ve been carefully monitoring portfolio performance and positioning over the past few months to make sure we’re not missing something from a risk perspective. Apart from performance, the main thing we look for is a spike in correlation with market or macro factors, along with intra-portfolio correlation changes driving a spike in risk contribution (and hence risk) from any part of the portfolio.

Disappointing performance notwithstanding, short-term volatility of the Fund has normalised following a modest spike in the August drawdown. Moreover, FX Carry – which was the main driver of both negative performance and higher volatility – has ceased being such major sourced of risk in the portfolio. Risk leadership now belongs to Commodity Vol (in particular Oil Vol), largely a result of tit-for-tat missile strikes between Iran and Israel.

We monitor both the relative and the absolute level of risk in the portfolio, and while the relative risk (measure by percentage contribution to risk) in Commodity Vol is high when measured over the very recent history, the absolute magnitude of risk is still quite low. Additionally, as mentioned previously, where we have short vol exposures we carefully size positions to ensure the portfolio is not overly exposed to large price shocks. We are not concerned that our exposure is too concentrated at this point.

The net outcome is we’ve entered a “wait-and-see” period for the Fund. Consecutive idiosyncratic shocks have temporarily impaired portfolio performance, however, that’s always going to be a risk with an investment approach spanning multiple asset classes with extremely disparate investment exposures. While we are mindful of short-term performance – which may signal structural changes affecting future performance potential – we also recognise that temporary setbacks are part and parcel of any investment approach. For now, we’re comfortable with our exposures, but will continue to monitor the associated risks in the portfolio.

Monthly returns (%)1