Monthly Report November 2024

Fund objective

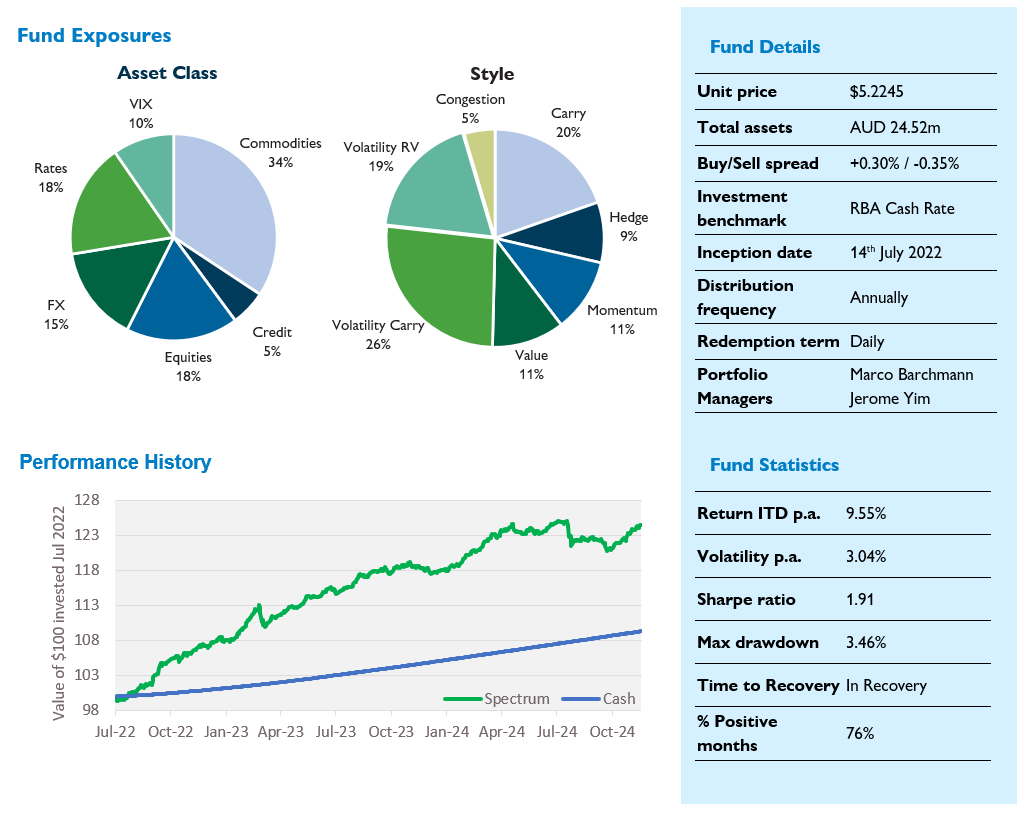

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 1.67 | 1.72 | 5.19 | 7.63 | 9.55 |

| RBA cash | 0.34 | 1.06 | 4.33 | 4.03 | 3.73 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 29 November 2024

Monthly commentary

Spectrum gained 1.67% in November, taking CYTD gross performance to 5.59%. Since inception, performance stands at 9.55% p.a. versus 3.73% p.a. for the Fund’s cash benchmark, an outperformance of 5.82% p.a. Annualised volatility has been 3.04%, for a gross since-inception Sharpe ratio of 1.91.

There was a high degree of uncertainty going into the US Presidential election, however, in the end the result was so comprehensive that any fears of contested election or civil unrest went out the window. The knee-jerk reaction was new record highs for equities and a collapse in volatility. Given the outsized moves (lower) in volatility, it’s not surprising that volatility strategies were the main driver of performance for the month. Vol Carry (+0.67%) was the best performing strategy group with Vol RV (+0.43%) not far behind. Momentum (+0.22%) strategies also performed well in November. Perhaps unsurprisingly given the strong rally in risk, Hedge (-0.08%) was the worst performing strategy group.

Our investment philosophy around systematic strategies is that small but persistent market distortions exist as the result of supply/demand imbalances, and we design systematic strategies to take advantage of these distortions. Simplistically, it’s essentially a “multi-trial” approach whereby the market distortion gives us edge. Each trial return might be positive or negative, however, by repeating the trial every day we can, over time, generate positive expected returns.

Large idiosyncratic events can lead to outsized returns in our strategies which are unrelated to the market distortion we’re targeting. Ex-ante we can’t know whether the return from such events will be positive or negative, and often we can’t even know that the event is coming. However, events like a US Presidential election are “known-unkowns” where we know that a) the timing of the event; b) the return is likely to be unrelated to the distortion we’re attempting to monetise; and b) the magnitude of the return could possibly be very large compared to the usual daily return distribution of the strategy. This can skew the return distribution from a strategy in undesirable ways, for example, where we make regular but small investment gains from our systematic strategy that are erased by a single event-day return.

In order to address this risk, we entered into some portfolio hedges over the election, buying some very short-dated low strike SPX puts and hedging some of the USDMXN exposure in our FX Carry strategy. These hedges were targeted to reduce (not reverse) some of our portfolio exposures we considered particularly sensitive to the election outcome, and the overall impact on the portfolio was, in the event, very modest (-0.04%).

While the strategies we invest in are systematic, the precise model parameters, along with the choice of which strategies to hold in the portfolio at any given point in time are active and discretionary portfolio management decisions. We don’t just passively hold a fixed set of systematic strategies; we adjust our positioning taking into account observable economic and market variables on the basis that different strategies work better in different market environments. The above event hedges are a natural part of our investment and risk management processes which involve actively managing a portfolio of systematic strategies. To be clear, we do not taking an active view on the outcome of a particular event. Rather we may selectively derisk the portfolio to avoid a foreseeable idiosyncratic shock adversely impacting investment returns.

Monthly returns (%)1

1Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com