Monthly Report January 2025

Fund objective

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 1.27 | 3.55 | 6.77 | 7.95 | 9.66 |

| RBA cash | 0.36 | 1.08 | 4.34 | 4.14 | 3.77 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance.

Source: Fidante Partners Limited, 31 January 2025

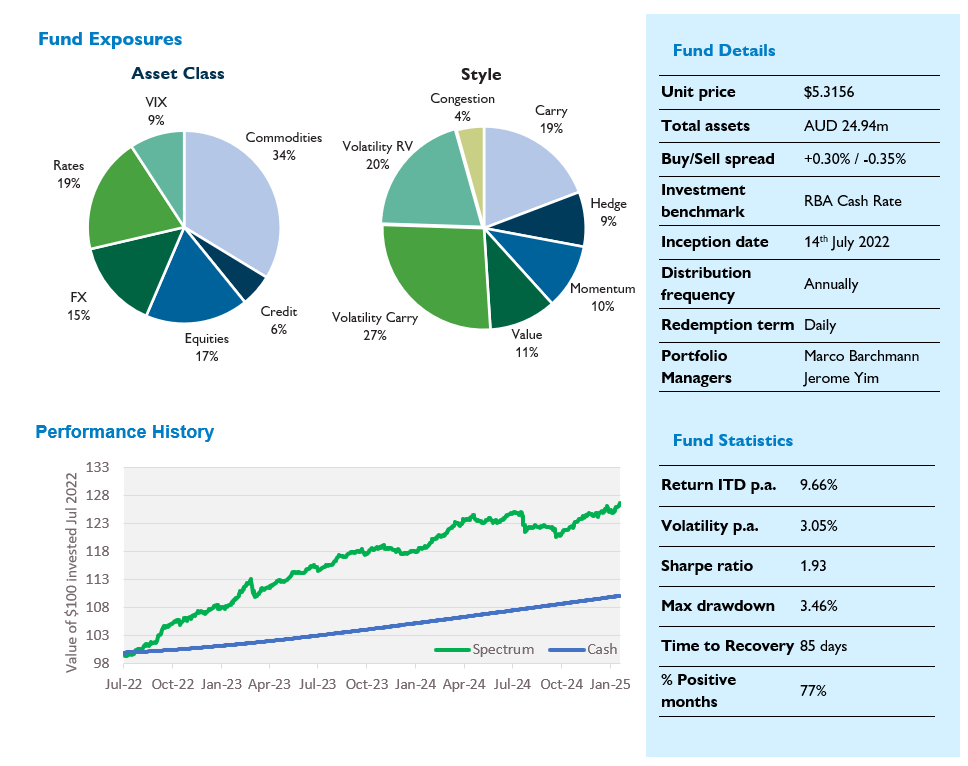

Monthly commentary

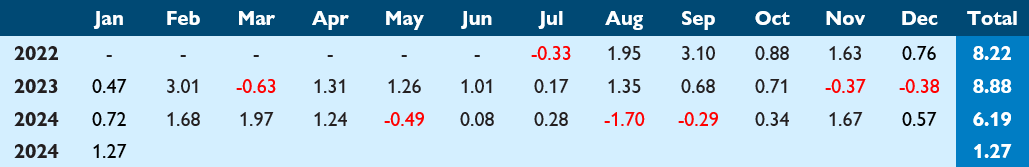

Spectrum had a solid start to 2025, posting a gross return of 1.27% in January. Since inception, gross performance stands at 9.66% p.a. versus 3.77% p.a. for the Fund’s cash benchmark, an outperformance of 5.89% p.a. Annualised volatility stands at 3.05%, for a gross since-inception Sharpe ratio of 1.93.

The commodity complex was the main contributor to returns in January, with Commodity Vol (+0.28%), Commodity Carry (+0.27%) and Commodity Value (+0.14%) the top performing strategy groups. Rates Vol RV (+0.11%) also continued its recent run. Rates Trend (-0.18%) was the only notable negative for the month.

The overall market theme in January was one of re-evaluation following some large “Trump trade” moves. 30-year Treasury yields touched 5% – nearing the highs from October 2023 – before retracing lower to end the month broadly unchanged. Equities were also mixed, with SPX initially selling off on the back of higher yields before recovering to new all-time highs later in the month. Inflation and the impact on Fed policy has also returned as a theme, with fears of large fiscal deficits and trade wars driving renewed inflationary concerns. As if inflationary concerns weren’t enough, the additional DeepSeek bombshell late in the month stoked fears that the AI bubble – a massive driver of overall market performance in 2024 - might be on the verge of popping.

All the above factors will no doubt impact our performance in some way, however, ex-ante we couldn’t say which way or even in most instances which strategy. As an illustration, the table below shows the count of the number of months where Spectrum performance is positive/negative contingent on performance of S&P 500 and Global Aggregate. For example, the first row shows there have been 14 months where both S&P 500 and Spectrum had positive performance, and 7 months where S&P 500 performance was positive, but Spectrum performance was negative. Spectrum has (so far) served as a good diversifier to both equities and fixed income (Spectrum positive each time either S&P 500 or Global Agg performance was negative), but overall, there’s no obvious linear relationship between Spectrum’s performance and either equities or fixed income.

Spectrum Up | Spectrum Down | |

|---|---|---|

| SPX Up | 14 | 7 |

| SPX Down | 10 | 0 |

| Global Agg Up | 8 | 7 |

| Global Agg Down | 16 | 0 |

We had called out last year that commodity strategies have become more prominent (in terms of returns) within the portfolio. We don’t mind this because the factors driving commodity prices and term structures are often unrelated to the traditional macro factors driving other asset classes such as equities and fixed income. It’s not obvious that higher rates or higher inflation or lower equity markets (or the opposite!) will have any impact on the performance of the commodity strategies we hold in the Fund. Even the strategies which trade interest rates or FX or equities are not obviously directly impacted by directional market movements.

This sits very comfortably with us, since our entire investment philosophy revolves around a view agnostic approach to investing. We are not trying to predict which way markets will move, nor are we harvesting beta by blending asset class exposures. Rather, we’re attempting to generate uncorrelated alpha by systematically taking advantage of market distortions, which themselves are mostly independent of market direction. Ex-ante we don’t really know and we don’t really mind which way markets move, because we’re seeking to deliver consistent performance regardless of market direction.

Monthly Returns (%)1

1Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com