Monthly Report December 2024

Fund objective

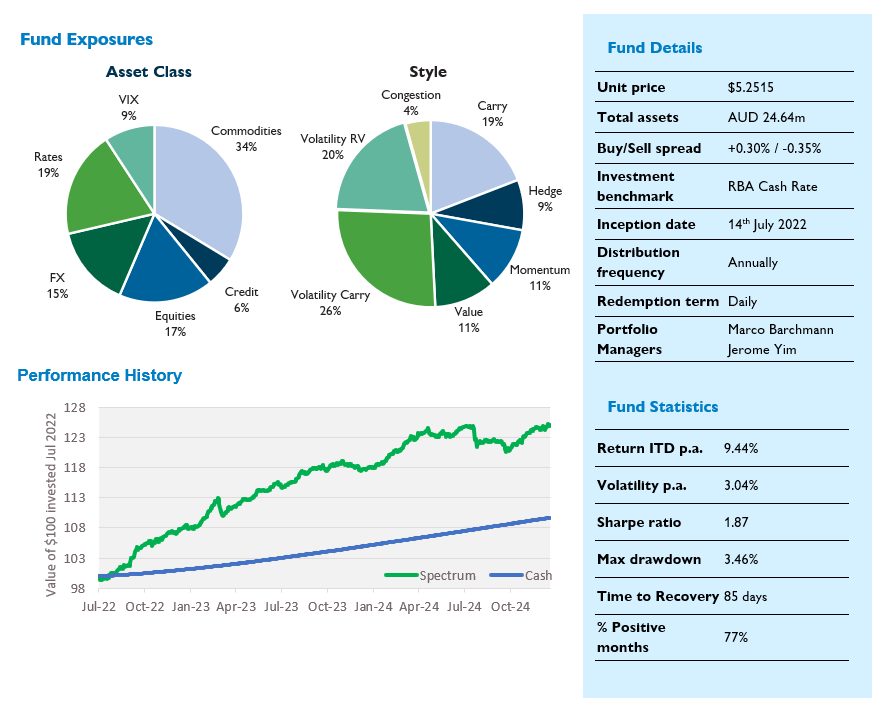

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 0.57 | 2.60 | 6.19 | 7.51 | 9.44 |

| RBA cash | 0.37 | 1.08 | 4.37 | 4.09 | 3.75 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance.

Source: Fidante Partners Limited, 31 December 2024

Monthly commentary

Spectrum gained 0.57% in December, taking 2024 gross performance to 6.19%. Since inception, performance stands at 9.44% p.a. versus 3.75% p.a. for the Fund’s cash benchmark, an outperformance of 5.69% p.a. Annualised volatility has been 3.04%, for a gross since-inception Sharpe ratio of 1.87.

The post-election themes of higher long-end rates, a stronger USD and positive equity markets continued into December. This meant that Vol Carry (+0.63%) continued to perform well together with Vol RV (+0.15%) and FX Carry (+0.15%). Higher oil and natural gas prices meant that our commodity carry strategy (-0.38%) was the worst performer in December.

In December we introduced a new long-gamma defensive strategy implemented on the S&P 500 index. The strategy has a flat to slightly negative carry profile but performs well in large S&P 500 downside moves such as the one we saw on 18 Dec 2024. The strategy had a +2.6% return that day lifting the fund by 5.8 bps.

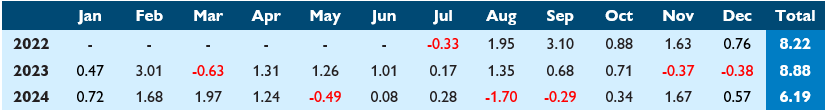

For 2024 overall, the portfolio achieved a cumulative gain of 6.19%. Performance was particularly strong in the first quarter, with March delivering the highest monthly return of 1.97%. Mid-year challenges emerged, with notable drawdowns in August (-1.7%) mainly driven by exchange rates rather than equity markets. Despite these setbacks, the portfolio rebounded later in the year, highlighted by a significant December quarter recovery (+2.69%). In terms of asset class performance, commodities delivered the highest contribution at 0.79%, followed closely by FX at 0.71%. Interest Rates also added positively, contributing 0.43%. Equity had a negative impact on the fund's performance, with a contribution of -0.24%. This was largely due to many of our hedge strategies being implemented through equities.

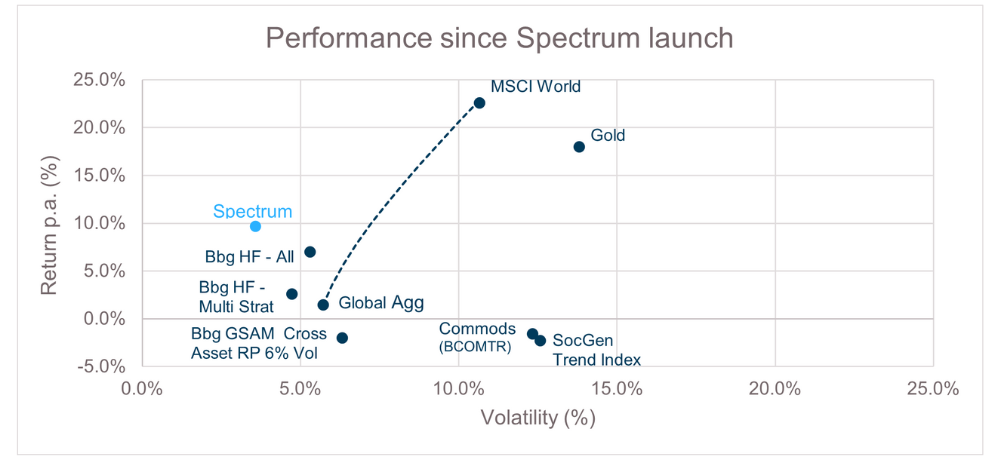

Closing another year is also an opportunity to compare Spectrum’s performance to other asset classes. In Figure 1 we show the since inception live performance and risk of the Spectrum fund compared to other asset classes. All non-AUD returns are hedged back to AUD. Over the past 2.5 years, international equities and gold delivered exceptional performance. In contrast, fixed income (Global Agg), commodities (BCOM), and trend-following strategies (SG Trend Index) hovered around 0.0% annualized returns. Hedge funds, including multi-strategy hedge funds and the Spectrum Fund, performed well on a risk-adjusted basis, as indicated by their position to the top-left of the dashed equity/fixed income portfolio line. This demonstrates their ability to significantly enhance the risk-adjusted returns of traditional asset allocation portfolios.

Figure 1 Performance vs volatility since 14-Jul-2022

1The performance for Bbg HF – All & Bbg HF – Multi Strat excludes Dec 24 since the data is not available yet.

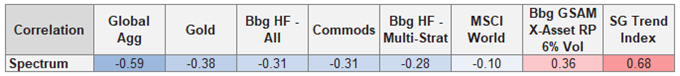

Another reason adding Spectrum to traditional asset allocation portfolios is the diversifying nature of the returns. The correlation to traditional asset classes and many other alternative asset classes was very low or negative with the exception of the SG Trend Index, which itself also represents a diversifying investment style.

Table 1: Correlation - Spectrum vs asset classes (monthly returns, since inception)

It’s also worth noting that while correlation to SG Trend Index looks optically high, Spectrum’s performance was meaningfully positive in 2024, while SG Trend Index performance was slightly negative. For investors seeking a source of diversifying returns, the Spectrum Fund could be worth considering alongside CTAs. It offers similar diversification benefits while placing greater emphasis on achieving strong risk-adjusted returns.

As we've highlighted before, the Spectrum Fund has a dual objective: 1) generating absolute returns and 2) maintaining a low correlation with traditional asset classes – both of which the fund has successfully delivered to date. We believe a significant contributor to this outcome is the active portfolio management and the discretionary selection of systematic strategies that we invest in. This investment approach, along with the broader array of strategies deployed, is what differentiates Spectrum from other diversifying strategies such as CTAs.

Monthly Returns (%)1

1Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com