Monthly Report August 2024

Fund objective

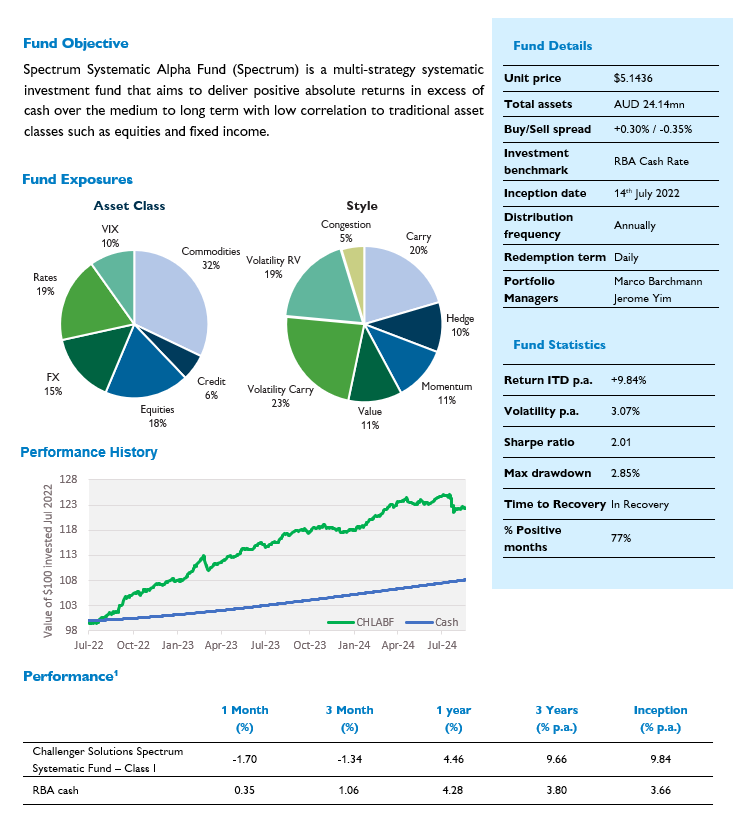

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

1 Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 August 2024

Monthly commentary

Spectrum posted a loss of -1.70% in August, lowering CYTD gross performance to 3.80%. Since inception, performance stands at 9.84 % p.a. versus 3.66% p.a. for the Fund’s cash benchmark, an outperformance of 6.18% p.a. Annualised volatility has been 3.07% over the same period, for a gross since-inception Sharpe ratio of 2.01.

Unsurprisingly, some of the worst performing strategies in the month were volatility related. Specifically, Rate Vol RV (-0.34%), VIX Vol RV (-0.28%) and Credit Vol (-0.22%). FX Carry (-0.27%) was also a detractor. By contrast, Equity Vol (-0.01%) was pretty much flat for the month despite the outsized moves. VIX Hedge (+0.11%) and FX Value (+0.06%) where the main positive contributors.

Most of the losses came right at the start of the month. First an interest rate hike from the BoJ triggered a sharp unwind in short-JPY carry positions, then a weaker than expected US payrolls print raised fears of a US recession. These two factors came to a head on Monday 5th August, when Nikkei fell precipitously, posting a -12.4% daily loss, the largest since October 1987. US markets were also impacted, with S&P 500 futures down as much as -4.4% intraday, and VIX up a whopping +181% to 65.7 at one point, a level usually associated with full-blown crisis (VIX has only been higher during GFC and Covid). Spectrum wasn’t immune to the moves, posting losses of -2.4% over the first few days of August. In the context of such large moves in some of the markets we are heavily involved in (JPY FX and VIX to name just two) we think that’s a tolerable outcome, and evidence that while our multi-strat approach can’t reduce all risk, at a minimum it can serve as a buffer during turbulent markets.

A dynamic we’ve discussed previously is the relationship between risk, yields and FX (specifically FX Carry). This is important for us from a portfolio construction perspective because we don’t want to unwittingly overweight our exposure to any of those investment factors. Up until now, Spectrum had explicit exposure to higher yields via a short position in money market futures (from Rates Trend) and implicit exposure from FX Carry. This is an aspect of our portfolio we have been monitoring to ensure we’re not over-exposed to directional interest rate movements. Indeed, it has been a large source of the recent poor performance. We expect FX Carry to continue to be directional with the level of yields, however, over the course of the last month, our Rates Trend strategy has flipped from net short to net long rates. Therefore, going forward we expect Rates Trend and FX Carry to be diversifying to each other.

The flip in positioning within Rates Trend is particularly timely, reducing a large source of risk currently in our portfolio (yields) and endogenously maintaining diversification. Changes in monetary policy cycles often lead to changes in relationships between different strategies, which needs to be managed in order to achieve our low correlation objective. Rates Trend can help address this by flipping position as the monetary policy cycle changes, and this is precisely why we include the strategy despite its more directional nature.

Monthly returns (%)1