Our BDMs are on hand to help you to answer your Aged Care advice questions or help you run a quote.

Guide your clients through aged care with certainty

Demand for aged care and aged care advice has never been greater and continues to grow. With our unique investment solution Challenger CarePlus, you can be better equipped to guide your clients through their next stage of life, help them achieve peace of mind knowing that they will receive monthly payments for their lifetime. Challenger CarePlus provides a reliable source of fixed monthly income to cover the ongoing aged care costs and offers support during the moments that matter most.

Benefits of Challenger CarePlus

CarePlus provides fixed monthly payments for the life of your client, helping manage their aged care costs and living expenses. Compared to alternative investments strategies such as term deposits and investment bonds within a family trust, CarePlus could provide a greater range of benefits to your clients:

- Guaranteed payments for life - CarePlus can provide your client with the peace of mind knowing that they will receive monthly payments for their lifetime (to help fund aged care costs), regardless of how long they live or how investment markets perform.

- Certainty and control over estate planning outcomes - CarePlus allows your client to choose who will receive the lump sum payment upon their death. Challenger will pay 100% of the amount invested to the investor’s nominated beneficiary(ies) or the estate. (Residents of South Australia will receive 100% of the amount invested less the amount of stamp duty initially paid by Challenger.)

- Potential Age Pension increase and reduction in aged care fees – After investing in CarePlus, any Age Pension your clients receive may increase and the amount they pay for aged care (ongoing fees) may reduce due to the favourable social security means test assessment.

- Tax efficiencies – Only part of the regular payments from CarePlus are subject to tax and there is generally no tax payable on any death benefit when it is paid to nominated beneficiaries or the estate.

- No fees – There are no fees or charges payable to Challenger.

- Competitive payment rates - CarePlus has competitive payment rates.

Who is CarePlus suitable for?

CarePlus may be suitable for people who are considering aged care services or who may already be using aged care services (it can assist clients already in care who have investable assets (or have a change in circumstance i.e. home sale proceeds, inheritance from partner passing away). For details download the Aged Care Flyer.

As with all investments, CarePlus carries some risk. Please consider the Target Market Determination and provide the relevant Product Disclosure Statement (PDS) before deciding to invest. These risks and how they are managed are set out in the PDS. We recommend you go through them with your client before deciding to invest.

CarePlus is comprised of two products:

- CarePlus Annuity, providing guaranteed regular income; and

CarePlus Insurance, providing a lump sum death benefit.

By investing in CarePlus, you are investing in both the Annuity and Insurance - in one easy solution.

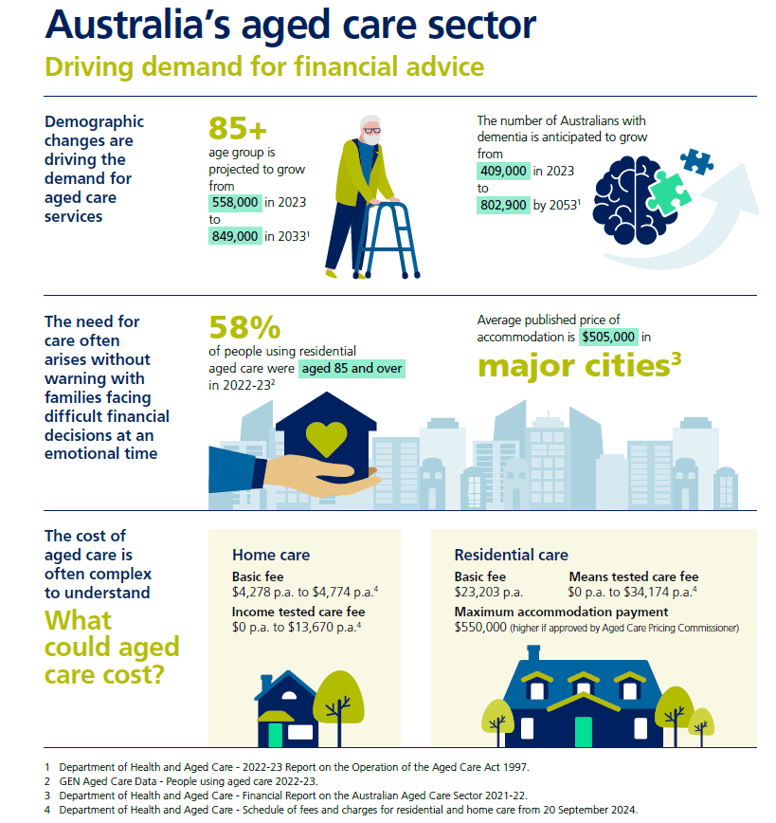

Demand for aged care advice has never been greater and will continue to grow

Aged Care resources

Adviser tools and resources

Aged Care Calculator

.png?h=1485&iar=0&w=2640)

Award-winning technical help

Speak to our Distribution team

Our Challenger Distribution team are experienced in helping advisers develop retirement and aged care strategies that help give clients confidence in retirement. Fill in the form to request a meeting with a Challenger BDM.